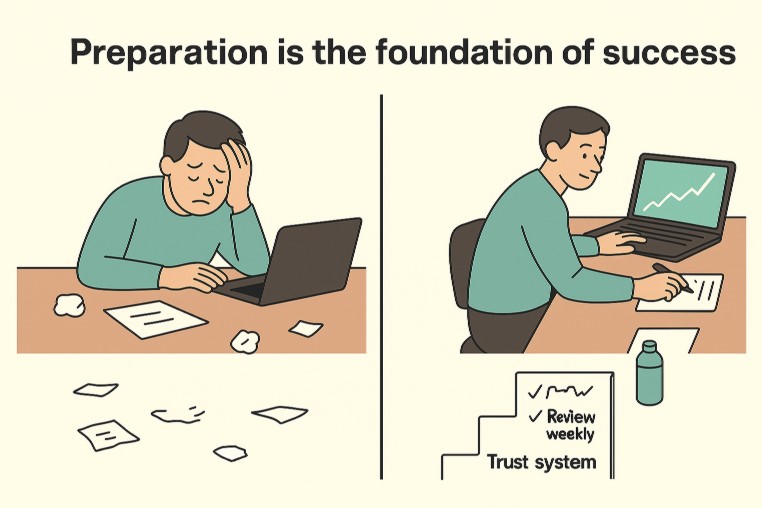

Overview: Preparation isn’t just about knowing what to do. It’s about forming good habits, using good systems, and following verified processes that help you stay consistent in the face of both wins and losses. Whether in sport or trading, preparation separates those who endure from those who burn out.

Most people focus on results. They only see the win, the profit, or the success story. But it’s the preparation that actually produces results, and it happens way before the win comes.

Athletes don’t just show up on race day. They train for months, keep up their diet, and plan for what might go wrong and resolve them ahead of time.

Traders aren’t any different. They also need to train and prepare, as the market can throw surprises, streaks, and setbacks. This makes the difference between those who last and those who fail: it’s how well they’ve prepared.

This article explores why preparation is the foundation of successful trading, how it parallels endurance sports, and what specific habits traders need to develop to handle both wins and losses with confidence.

Why Is Preparation the Foundation of Trading Success?

In almost everything: sport, business, trading, and even hobbies, success often comes down to preparation. Those who take time to plan avoid costly mistakes, get less stressed, and enjoy trading even more.

Research in psychology shows that preparation reduces stress by increasing confidence in your ability to respond to challenges. When you’ve thought through scenarios, through best and worst, you’re less likely to panic when something unexpected happens.

Key takeaway:

Preparation builds confidence and lowers stress.

What Can We Learn About Trading from Endurance Sports?

A friend once participated in a 24-hour mountain bike race. From Saturday lunchtime to Sunday same time, he battled fatigue, freezing temperatures, and his own mind telling him to quit. It sounds extreme, but he finished and enjoyed the whole ordeal.

How? Preparation.

He trained for months, built up his range through night riding, monitored his diet, and had a plan when fatigue hits. So during the race, when it was near freezing at 3:30 a.m., he didn’t quit because he already knew what steps to take.

This kind of preparation looks a lot like trading. Both require:

- A training plan (systems and rules).

- Monitoring performance (against self and benchmarks).

- Health and stamina (mental and physical).

- Risk control (avoid crashes, stay in the game).

Key takeaway:

Preparation in one field (sport) mirrors what works in another (trading).

How Does Preparation Apply to Trading?

Like this cyclist, traders face fatigue, setbacks, and moments of doubt. Preparation means having the processes that keep you steady when these moments happen.

Know the probabilities.

-

- Every system has a defined edge and expectancy, which determines how it performs over time. Market variability will naturally produce winning streaks, losing streaks, and drawdowns, but your system ensures that, in the long run, wins outweigh losses.

Accept all outcomes.

-

- You will inevitably have losses. But you will have wins. Expect both.

Trust the process.

-

- Systems, especially verified ones, are designed to work consistently, but not every trade will be a win. What matters is the long-term outcome: over time, your statistical edge shows itself, and winning trades outweigh losses. Focusing on the process rather than individual trades keeps you disciplined and prevents short-term results from derailing your strategy.

Research supports this approach. A 2018 study in Frontiers in Psychology found that accepting uncertainty reduces decision fatigue and improves long-term performance: a principle that directly applies to trading, where outcomes are never guaranteed. By preparing mentally and operationally, you create a buffer against stress and make more objective, profitable decisions.

Key takeaway:

In trading, preparation means accepting uncertainty and sticking to your system regardless of market conditions.

What Daily Processes Help Traders Stay Prepared?

Preparation isn’t a one-off; it’s daily. Traders who build routines don’t waste energy deciding what to do next… they just follow the plan.

A sample daily routine might include:

- Running scans at the same time each day.

- Entering or exiting trades based on signals (not feelings).

- Recording trades and results.

- Reviewing open positions.

This aligns with James Clear’s Atomic Habits, where he notes: “You do not rise to the level of your goals. You fall to the level of your systems.”

Key takeaway:

Daily routines create consistency. Consistency builds results.

Why Compare Performance Against Others?

Monitoring your system against benchmarks isn’t about ego. It’s about understanding your progress clearly.

Start with internal comparisons: track your results against your own goals to see how much you’re improving over time. Then move to external comparisons: look at other traders in your community or market benchmarks (like the S&P 500) to see how your system performs in real-world conditions.

Compare your results to:

- Other traders in your community.

- Market benchmarks (like the S&P 500).

- Your own goals.

Key takeaway:

Benchmarks keep your performance on track.

Why Are Exit Strategies Part of Preparation?

Without exits, traders crash out like cyclists without brakes. Losing capital too quickly takes you out of the game before the wins come.

Exit preparation includes:

- Stop-loss rules.

- Risk-per-trade limits.

- Capital preservation priorities.

Remember: You can’t profit from future winning trades if you’re already out of the market.

Key takeaway:

Exit strategies keep you in the game long enough to win.

What’s the Common Thread Between Sport and Trading?

Both are endurance tests. Both test discipline, mindset, and preparation. In both:

- Knowledge matters.

- Processes matter.

- Monitoring matters.

- Resilience matters.

When markets get rough, prepared traders endure. Like the cyclist who rides through the cold night, they know discomfort passes, but results come from staying the course.

Key takeaway:

Preparation is endurance. Endurance brings rewards.

Final Thoughts

Whether riding a 24-hour race or trading through a market drawdown, preparation is what keeps you steady. It helps you plan for both good and bad outcomes. It gives you structure, benchmarks, and endurance.

Want to learn how to prepare like a professional trader? Join our Learn To Trade Properly (LTTP) program! You’ll train the same way athletes prepare: with systems, routines, and mindset habits designed to keep you consistent and confident.

Frequently Asked Questions

Why is Preparation so Important in Trading?

Preparation builds confidence, reduces stress, and helps traders respond objectively to market challenges. Like athletes, traders who prepare with systems, routines, and plans are better able to handle both winning and losing streaks.

How is Trading Similar to Endurance Sports?

Both trading and endurance sports test discipline, stamina, and mental resilience. Success from both also comes from planning, monitoring performance, and having strategies in place for setbacks, fatigue, or unexpected challenges.

What Does Daily Preparation for a Trader Look Like?

Daily preparation includes:

- Running scans

- Entering and exiting trades based on signals (not emotions)

- Recording trades and results

- Reviewing open positions

Consistent routines turn preparation into habits, which drive long-term results.

How Should Traders Handle Losses and Uncertainty?

- Traders must accept that losses are inevitable and trust their verified systems.

- Focusing on the process rather than individual trades prevents short-term losses from derailing long-term performance.

- Accepting uncertainty in your trading reduces decision fatigue and improves results.

Why are Exit Strategies a Key Part of Preparation?

Exit strategies, such as stop-loss rules and risk limits, protect capital and ensure traders stay in the game long enough to benefit from future winning trades. Proper exit planning is essential for preserving gains and minimising losses.