SPA3 Income

SPA3 Income is built for income.

A fully mechanical, rules-based swing-trading system to trade U.S. listed 3x & 2x leveraged ETFs.

The system’s design goal is to achieve growth of 2.5x the long-term annualized return of the S&P500 Total Return index, around 25% annualized return.

To enable income withdrawals, if required, while risk-managing drawdowns and still growing the trader’s initial capital by at least CPI.

How SPA3 Income Works

long-only, trend-following swing-trading system

Holding period: several days to several weeks

Universe: 31 liquid U.S. listed 3x & 2x leveraged ETFs

Portfolio: typically 5 simultaneously open positions

Execution: Market on Close (MOC) orders

Time Required: 30 minutes / week, on average

The Technical Engine

ATR volatility breakouts for entries on daily data

ATR trailing stops for exits

Overbought profit-taking exits to reduce end-of-trade drawdown

Pattern-based weakness exits on selected ETFs

The “Rainy Day” Income Framework

Income does not come from every month being profitable.

It comes from trading properly and managing capital properly.

This grows, then protects your trading capital and stabilizes withdrawals over time.

Trade for high growth during strong periods

Periodically reset your base capital

Move excess profits into a “rainy day” account

Draw income from that reserve during flat or losing periods

Who SPA3 Income Is For

- Volatility & liquidity seekers w/o chasing come-and-go small caps

- Leverage seekers who dislike paying interest on margin or CFDs

- Achieving consistent leverage unlike buying Options with 2x to 15x leverage

- Those wanting directional, simple 'long' trading; like trading stocks

- Those tired of complex, non-linear, time-hungry selling of Options

- Not for day traders

- Not for people who ignore rules

- Not for investors who only need Index, or less, type returns

- not for people who cannot tolerate drawdowns or equity fluctuations

- not for anyone undercapitalized or dependent on immediate withdrawals

USA Leveraged ETFs - SPA3 Income Simulation

(5 positions with no brokerage fee US$75K Capital)

ETFs are commission-free in the U.S.

Important Notes

Portfolio Simulation can ONLY be conducted once unambiguous and objective entry (buy) and exit (sell) criteria are locked-in following rigorous trading system research. Such simulation CANNOT be done if a trader uses discretionary, ambiguous or subjective trading criteria.

The Simulated 3, 5 and 10-year results below are obviously conducted on historical price data. “Every moment in the market is unique.” (Mark Douglas) Meaning, “anything can happen”, as the future is unique, and obviously unknown.

Therefore, every mechanical system will perform worse on future price data than on the historical price data on which it was researched.

SWS released our first mechanical trading system for stocks in 1998, which is still in use. We are fully versed with, and how to avoid, “curve fitting”.

What does this mean for the historical Simulation results below?

From our 30 years of trading system design & research, and then live trading of those systems for many years after the research, traders should expect to achieve in the range of 1/2 to 3/4 of the simulated historical annualized returns in live-trading going forward.

The lower the Simulated results the lower the live-trading results.

November 30, 2022 to December 1, 2025

Performance vs Market

- Annualized return: 67.44% vs 21.55% (S&P500 TR index) → ETFs are traded with $0 brokerage in the U.S.

- Future live-trading expectation in 21.55% Annualized Return market conditions over 3 years → 33% to 50%.

- Future live-trading expectation in 21.55% Annualized Return market conditions over 3 years → 33% to 50%.

- Total gain (ROC): +371.46% → end value ≈ $353,596.98.

- P&L mix: Net profit $278,596.98 including Dividends $2,599.89.

Risk/Drawdown (what actually breaks traders)

- Max drawdown: −19.21% (dated 9/6/2024) vs index −18.75% (4/8/2025).

- Future live-trading expectation in 21.55% Annualized Return market condition over 3 years → -25% to -30%.

- Future live-trading expectation in 21.55% Annualized Return market condition over 3 years → -25% to -30%.

- Risk : Reward (DD per unit return): 0.28 vs index 0.87 → far better pain-for-gain.

- Average exposure: 76.52%

- Current drawdown: −5.40% (index −0.98%).

Edge Mechanics (why the math works)

- Win rate: 59.60%.

- Payoff Ratio: 3.07 (avg win +18.80%, avg loss −6.13%).

- Expectancy: +1.43R per trade = “edge” = Mathematical Expectation

- Profit Factor: 4.00;

- Sharpe Ratio: 2.08.

- Avg per trade: +8.23% or $2,814.

- Avg hold: 43 days; winners 52 vs losers 29 → winners ride ~1.8× longer.

Trade Distribution (whole window)

- Total positions: 99 (59 wins / 40 losses).

- Largest win / loss: +$28,828.80 (+65.95%) / −$17,375.50 (−25.40%).

- Streaks: up to 11 wins and 6 losses consecutively.

- Ex-div trading P/L: $275,997.09 (risked $3,386,132.65, received $3,662,129.74).

- Avg net per trade (ex-div): $2,787.85 (wins $6,238.78, losses −$2,302.27).

You turned $75k → ~$353.6k in ~3 years, outpacing the S&P500 TR index benchmark by a mile with +1.43R Expectancy. The engine is clear: ~60% wins, winners ~3× larger than the losers, held longer, with low pain and low time required per unit of return.

Keep executing: take every signal when cash is available, cut losses quickly by the rules, never negotiate exits.

November 30, 2020 to December 1, 2025

Performance vs Market

- Annualized return: 74.01% vs 15.14% (S&P500 TR index) → ETFs are traded with $0 brokerage in the U.S.

- Return on capital: +1,502.64% → end value ≈ $1,201,977.58 from $75k.

- P&L mix: Net profit $1,126,977.58 = $1,117,475.62 (ex-div trading P/L) + $9,501.96 dividends.

Risk/Drawdown (what actually breaks traders)

- Max drawdown: −20.08% (10/14/2022) vs index −24.49% (10/12/2022).

- Risk : Reward (DD per unit return): 0.28 vs index 1.62 → far better pain-for-gain.

- Average exposure: 76.12%; current DD: −5.38% (index −0.98%).

Edge Mechanics (why the math works)

- Win rate: 61.11%.

- Payoff Ratio: 3.22 (avg win +19.34%, avg loss −6.02%).

- Expectancy: +1.58R/trade = “edge” = Mathematical Expectation

- Profit Factor: 4.11;

- Sharpe Ratio: 2.31.

- Avg per trade: +8.37% or $6,956.65.

- Avg hold: 44 days; winners 52 vs losers 31 → winners ride ~1.7× longer.

Trade Distribution (whole window)

- Total positions: 162 (99 wins / 63 losses).

- Largest win / loss: +$97,843.20 / −$58,937.69; Largest %: +76.55% / −25.40%.

- Streaks: up to 11 wins and 6 losses.

- Flows: Risked $−13,456,821.90, Received $14,574,297.52 → ex-div net $1,117,475.62; avg net/trade $6,898.00 (wins $14,920.02, losses −$5,708.04).

You turned $75k → ~$1.202M in five years, crushing the S&P500 TR index benchmark with a +1.58R expectancy and PF 4.11—all while keeping drawdowns contained and using ~76% average exposure. The engine is simple: ~61% wins, winners ~3.2× losers, held longer.

Keep doing the boring, professional work; take every signal when cash is available, cut losses quickly, never negotiate exits.

November 30, 2015 to December 1, 2025

Performance vs Market

- Annualized return: 66.13% vs 14.56% (S&P500 TR index) → ETFs are traded $0 brokerage in the U.S.

- Return on capital: +16,023.91% → end value ≈ $12,092,934.68 (=$75k + $12,017,934.68 net profit).

- P&L mix: Ex-div P/L $11,917,843.61 + Dividends $100,091.07 = Net profit $12,017,934.68.

Risk/Drawdown (what actually breaks traders)

- Max drawdown: −20.09% (10/14/2022) vs index −33.79% (3/23/2020).

- Risk : Reward (DD per unit return): 0.30 vs index 2.32 → drastically better pain-for-gain.

- Average exposure: 76.93%; current DD: −5.38% (index −0.98%).

Edge Mechanics (why the math works)

- Win rate: 57.32%.

- Payoff ratio: 3.27 (avg win +20.37%, avg loss −6.22%).

- Expectancy: +1.45R per trade = “edge” = Mathematical Expectation

- Profit Factor: 4.05;

- Sharpe Ratio: 1.96.

- Avg per trade: +8.33% or $37,439.

- Avg hold: 45 days; winners 56 vs losers 28 → winners held ~2× longer.

Trade Distribution (whole window)

- Total positions: 162 (99 wins / 63 losses).

- Largest win / loss: +$97,843.20 / −$58,937.69; Largest %: +76.55% / −25.40%.

- Streaks: up to 11 wins and 6 losses.

- Flows: Risked $−13,456,821.90, Received $14,574,297.52 → ex-div net $1,117,475.62; avg net/trade $6,898.00 (wins $14,920.02, losses −$5,708.04).

You turned $75k → ~$12.09M over ten years while taking ~20% max DD versus the index’s ~34%. The engine is ruthless and simple: win a bit more than half the time, let winners be ~3.3× the size of losers, and hold them longer.

Keep doing the boring, professional work, take every signal when cash is available, cut losses quickly, never negotiate exits.

(period and market specific; past performance isn’t a guarantee of future results)

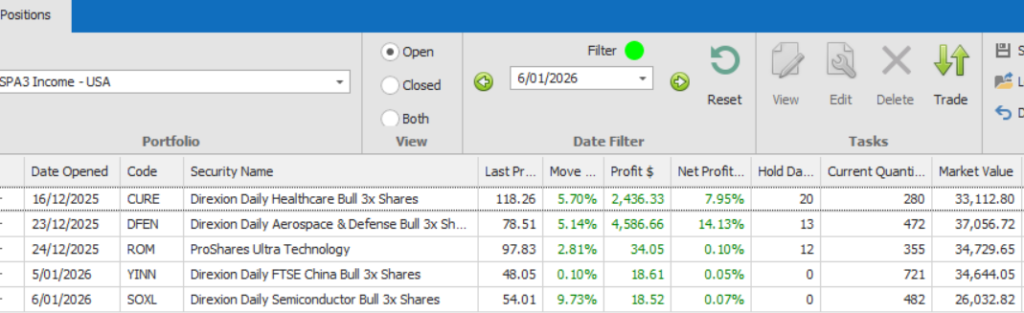

Share Wealth Systems manages four real-money, live-traded Public Portfolios, which all follow their respective mechanical trading systems precisely according to their respective rules:

- SPA3 Investor U.S Stocks; started 1 January, 2016

- SPA3 Investor ASX Stocks; started 1 January, 2016

- SPA3 Crypto, U.S crypto ETFs & Coins.; started 1 October, 2025

- SPA3 Income U.S. Leveraged ETFs; started 15 December, 2025

The SPA3 Income Public Portfolio Trading Plan can be viewed here.

The ongoing performance of the SPA3 Income U.S. Leveraged ETFs Public Portfolio will be updated here from time to time.

Currently Open Positions

This portfolio trades with a maximum of 5 simultaneously open positions.

The full list of Closed Trades is available upon request.

Email info@sharewealthsystems.com

The SPA3 Income Getting Started Manual is available upon request.

Email info@sharewealthsystems.com

(period and market specific; past performance isn’t a guarantee of future results)

Visit our FAQ page to learn more about this product

Profit-Before-You-Pay

We share your purchase risk with you - designed for committed learners who want results before paying for our system and tuition. for committed learners who want results before paying tuition-

+$99 per month (stock market data + unlimited support) (*Reward available based on prerequisite actions)

-

Train using SPA3 Income (your Learn To Trade Properly (LTTP) live-trading Study Group training system)

-

Weekly training path + practice targets so you always know what to do next

-

Live-trading Study Group sessions focused on execution (entries, exits, sizing) and Recovery from drawdown

-

Trade journal + review framework to build consistency and remove repeat mistakes

-

Completion unlocks benefits (eligibility for Profit-Before-You-Pay / MBG + transition to your purchased product)

Feedback From Our Customers