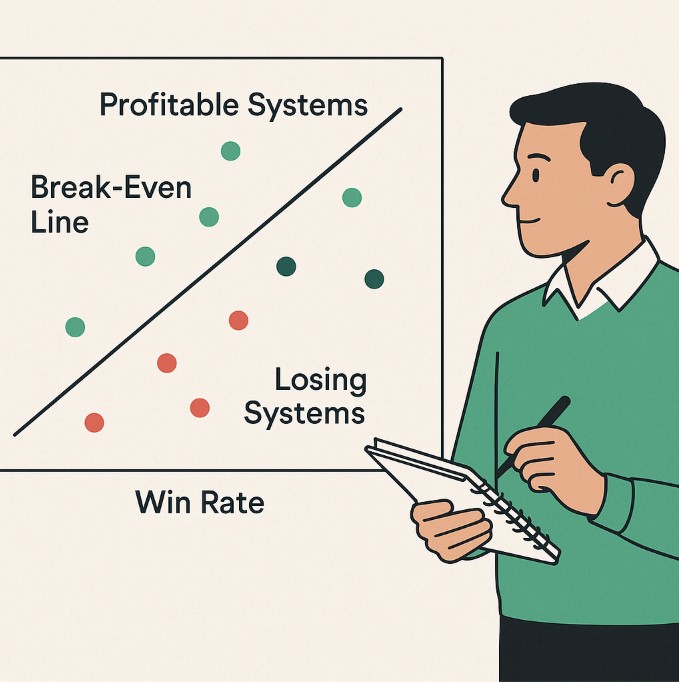

Overview: A trading edge isn’t about making every trade a winner , but about having probabilities on your side over many trades. The break-even line shows the minimum win rate and profit ratio you need to not lose money. Anything above that line can be profitable if paired with solid money management and good habits.

Every trader dreams of consistent profits. But dreams collapse quickly without one thing: an edge.

An edge is not luck, nor is it about predicting the next market move. It’s a repeatable process that tilts the odds in your favour over time. Without it, you’re trading without direction. With it, you’re running a system built on probability.

This article explains what an edge really is, how to measure when it’s “good enough,” and why the break-even line is the single most important concept most traders overlook.

Why Do Traders Need an Edge?

Most people begin trading full of enthusiasm. They read books, follow tips, and try to make sense of charts. At first, it felt exciting. But as losses piled up, emotions quickly took over.

That’s because without an edge, trading has no direction.

An edge is what separates a calculated process from blind luck. It’s the statistical advantage that says: over a large number of trades, your wins will outweigh your losses. Without it, even the best habits and excellent money management can’t save you.

Key takeaway

You don’t need to win every trade. You need an edge that tilts the probabilities in your favor.

What Is “Good Enough” for an Edge?

The natural question is: when is an edge actually good enough to trade?

The answer lies in mathematical expectation (ME).

- ME = 0 → break-even.

- ME > 0 → profitable over time.

- ME < 0 → losing system.

This is the threshold. A system with ME above zero, even slightly, can grow capital over time through compounding. Below zero, the edge isn’t good enough.

Key takeaway

A good edge isn’t about perfection. It’s about having a profitable mathematical expectation across many trades.

How Do You Measure Break-Even?

Two numbers matter:

- Win Rate (WR): The percentage of trades that win.

- Profit Ratio (PR): The size of winning trades compared to losing trades.

The formula is simple:

Break-even when (Win Rate × Profit Ratio) = 1

Example:

- If you only win 20% of trades, your winners must be 4x larger than your losers to break even.

- If you win 50% of trades, you only need your winners to equal your losers (1:1).

This relationship can be mapped as the break-even line. Anything above it makes money. Anything below it loses.

Key takeaway

Win rate and profit ratio always work together. A low win rate can still be profitable if winners are much larger than losers.

What Does the Break-Even Table Show?

This table means you can actually have more losing trades than winners and still make money, if your winners are large enough.

For example, a system with 34% winners only needs those winners to be twice the size of losers (1.94:1) to break even. Anything above that is profitable.

Key takeaway

A system can survive lots of losing trades if the profit ratio is sizable.

What Does a “Good System” Look Like?

A system doesn’t need to be far above the break-even line to make solid profits. Even small positive expectancy grows capital when compounding works in your favour.

For example:

A system with 45% winners and a profit ratio of 1.5 already produces long-term profitability.

If it’s paired with risk management and consistency, the equity curve will be smoother, with fewer gut-wrenching drawdowns.

Key takeaway

A good system is one that consistently stays above the break-even line, not one that looks perfect on paper.

Can a System Be Too Good?

Yes. A system that looks “too perfect” is usually over-optimized or curve-fitted.

Warning signs include:

- Very high win rates paired with unrealistic profit ratios.

- Too many rules or filters that fit past data but fail in real markets.

- Very small sample sizes (e.g., only a few dozen trades).

The U.S. Securities and Exchange Commission warns about systems that advertise extreme results without transparency

Key takeaway

An “excellent” system that looks flawless in testing is often unreliable in real life.

Why Does Money Management Matter?

Even a system with a strong edge can fail without risk control.

Placing all your capital on one trade? That’s a wager. Sensible position sizing spreads risk so that even a string of losses won’t wipe you out.

This is why professional traders emphasize position sizing and drawdown control as much as the edge itself.

Key takeaway

A good edge plus poor money management = failure.

What About Trading Psychology?

An edge only works if you can follow it. Many traders sabotage themselves by cutting winners short or refusing to take losses.

Psychologist Daniel Kahneman showed that losses hurt about twice as much as gains feel good. This bias makes traders abandon their system after a string of losses… even if the system is still sound.

The fix? Trust in your system’s edge. Trust comes from evidence, practice, and consistency.

Key takeaway

The best edge in the world fails without the right mindset to follow it.

How Close to the Break-Even Line Is “Good Enough”?

You don’t need to aim for the “perfect” system.

- Slightly above the break-even line = positive expectancy.

- Further above the line = smoother returns, smaller drawdowns, faster equity growth.

Think of it like riding a bike in a race. A well-built bike with well-crafted parts gives you the trust to push through fatigue. The same is true in trading.

Once you know your system is above the break-even line, your job is simply to execute.

Key takeaway

Even a modest edge compounds into significant returns over time.

Final Thoughts

Without an edge, trading has no direction. With an edge, probabilities work for you over time.

The key isn’t perfection. It’s having:

- A system with positive expectancy.

- Sensible risk management.

- The discipline to stick with it.

Preparation → Edge → Trust → Confidence → Execution.

That’s the sequence every trader must master.

Want to trade with a system that already sits well above the break-even line?

Our Learn To Trade Properly (LTTP) program gives you access to a rules-based system that has been tested, tracked, and shown to perform consistently above the break-even line.

You’ll learn exactly how the rules create that edge, how to apply them with precision, and how to manage your mindset so you can execute the system the way it was designed: calm, consistent, and long-term focused.

Frequently Asked Questions

Can I make money with less than 50% winning trades?

Yes. If your winners are bigger than your losers, even a low win rate can be profitable.

What’s the danger of over-optimization?

It creates systems that look good on paper but fail in real trading because they’re curve-fitted to past data.

Is money management more important than the edge?

They’re equally important. A good edge without risk control can still blow up an account.

How do I know if a system is trustworthy?

Look for verified long-term performance, transparency, and inclusion of real-world costs like slippage and brokerage.