Let me ask you something: Have you ever thought about what it costs to hand over your investments to someone else? I’m not just talking about the visible fees or commissions. I’m talking about the hidden, long-term losses that can silently chip away at your financial future.

If you’ve ever outsourced your investing to managed funds, financial advisers, mutual funds, SMAs, or robo-advisors, you might think you’re making life easier.

And in some ways, you are. But at what cost?

What Does Investment Outsourcing Mean?

When you outsource your investing, you hand over the responsibility of managing investments to someone else. This could be a fund manager, a financial adviser, or an automated platform. They make the investment decisions: what to buy, what to sell, how to allocate your funds.

This route can seem smart, especially if you feel overwhelmed by the world of finance. But it also means you lose a certain level of control, awareness, and growth.

Let’s say you start with $10,000. If you outsource that money to a managed fund or financial advisor, here’s what it could cost you:

- $11,000 in 10 years

- $70,000 in 20 years

- $336,000 in 30 years

- $1,437,000 in 40 years

The truth is, outsourcing your investing might spare you the emotional discomfort of volatility, uncertainty, and decision-making. But it also costs you something far greater.

Tired of letting others decide what happens to your money? Start your journey to trading properly and build the skills to grow your wealth with confidence.

5 Things You Might Be Losing Without Realising

1. Control Over Your Financial Future and Investment Management

Outsourcing your investments might spare you from decision fatigue, but also removes you from the driver’s seat. You’re essentially trusting someone else with your future lifestyle.

You don’t feel the pain of losses directly. But that also means you don’t build the resilience or clarity that comes from learning the hard lessons yourself.

2. Learning Opportunities

Every time you don’t make a decision, you miss out on an opportunity to grow. DIY investing forces you to learn: how the market works, how to manage emotions, and how to stick to a plan.

When you rely on someone else, that learning curve stays flat. And later in life, that lack of knowledge could come back to bite you when it matters most.

3. A Lot More Money Than You Think

Let’s do a little math.

Investing $10,000 via traditional third-party methods could cost you $11,000 in 10 years. Or $70,000 in 20 years. Or $336,000 in 30 years. And get this, it could cost you $1.4 million in 40 years.

That’s right. By simply handing off your investments, you’re potentially losing out on hundreds of thousands (or even millions) due to fees, underperformance, and the magic of compounding investment returns being diluted.

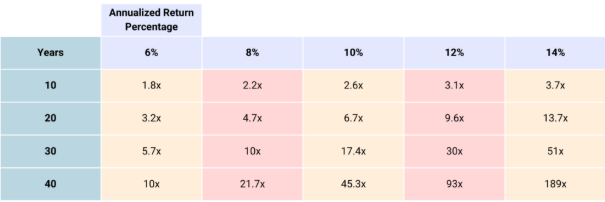

Here’s a breakdown that shows just how much of a difference your annualised return percentage can make:

The actual difference in performance can be shocking. If you start with $5,000 at age 25:

- 6% annual return: $9,000 after 10 years

- 8%: $11,000

- 10%: $13,000

- 12%: $15,500

- 14%: $18,500

It doesn’t seem like much over 10 years. But stretch that out to 30 or 40 years, and the gap becomes life-changing.

Most Funds Don’t Beat the Market… And Here’s the Proof

If you’re still holding out hope that your fund manager or advisor might beat the market in the long run, consider this your wake-up call.

The SPIVA Scorecard and Persistence Reports have consistently shown that most actively managed funds fail to outperform their benchmarks over time.

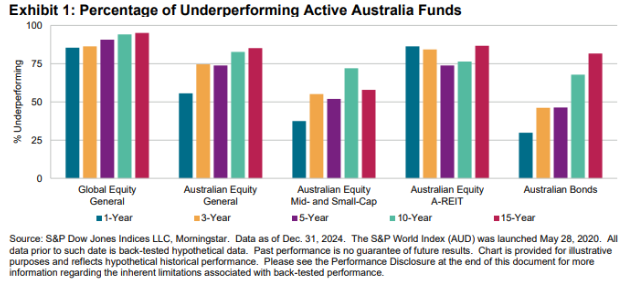

Here’s the most recent data from the S&P Dow Jones Indices (as of December 31, 2024):

This chart shows the percentage of underperforming active Australian funds across several categories and timeframes:

Over the past 15 years, around:

- 90% of Global Equity General funds

- 85% of Australian Equity General funds, and

- 78% of Australian Bond funds

All failed to beat their benchmarks.

Even mid- and small-cap funds, which are sometimes viewed as more “active manager-friendly,” had over 65% underperform over 15 years.

So, if you think outsourcing will help you consistently beat the market, the odds say otherwise.

Even if a fund does well one year, the SPIVA Persistence Report shows it’s unlikely to stay a top performer. Most top-quartile funds don’t stay there in the years that follow.

This is why institutional investors, despite their scale, often struggle with performance when over-diversifying or following rigid outsourcing models built around compliance rather than agility.

4. A Strategy That Reflects Your Personal Goals

Most outsourced investment plans follow a cookie-cutter model. Balanced fund. Target-date retirement plan. Generalized risk profiles.

But your goals aren’t one-size-fits-all. You might want to retire early. Or invest according to your values. Or take calculated risks. The more generic your strategy, the more you compromise on what matters to you.

This is especially true if you’re interested in private market investments or alternative investments that require more flexibility and tailored approaches.

5. Emotional Ownership and Discipline

When you invest yourself, you build a relationship with your money. You develop discipline, patience, and the ability to tune out noise. It’s not always comfortable, but it’s how confidence is built.

Outsourcing? It can breed detachment. And when things go south, you’re more likely to blame others or make emotional decisions without fully understanding the risks.

Many investors assume that by paying investment management fees, they’re guaranteed better results, but those fees often just compound the problem over decades.

When Investment Outsourcing Does Make Sense

Now, I’m not saying outsourcing is evil. There are situations where it makes sense:

- You’re managing a large portfolio and need tax optimisation

- You simply don’t have the time or interest to manage your investments

- You need behavioural coaching to avoid impulsive decisions

In such cases, some investors turn to an outsourced chief investment officer (OCIO) model, usually used by institutions, but increasingly marketed to high-net-worth individuals.

But even then, you should know what you’re paying for and stay engaged with the process.

Even institutional investors are learning to stay hands-on by building internal teams and hybrid investment outsourcing approaches.

If you’re considering outsourced management, make sure it includes transparency, accountability, and clear alignment with your long-term goals.

How to Stay Involved Even If You Outsource

Here’s what I recommend if you’re working with an advisor or using managed funds:

- Review your statements regularly

- Understand your fee structure – are they taking 1% of your portfolio annually for doing very little?

- Ask why certain assets are being chosen (especially exchange-traded funds, which many advisors rely on heavily)

- Compare performance with a benchmark like the S&P 500 or ASX 200

- Run your own DIY investment portfolio on the side to learn and stay sharp

- Seek out investment advice that aligns with your actual financial goals, not just generic products

- Learn how your asset allocation decisions are being made and why

And don’t ignore risk management. Even a simple understanding of portfolio diversification, underlying investments, and volatility can make you a better investor, even if you outsource execution.

Final Thoughts: Your Future Deserves More

If you’re aiming for a comfortable, financially secure retirement, and I mean truly secure, without budgeting stress or regrets, you need to outperform what most third-party managers and investment outsourcing can offer.

That means either:

- Saving more (15% or more of your income every year), or

- Achieving higher returns on your capital.

The harsh reality? The retirement system no longer works for most people, and relying on outdated strategies might leave you short when it matters most.

DIY investing isn’t easy. It demands time, learning, and emotional resilience. But with the right system, mindset, and support, you can do it.

And the rewards? They’re far greater than just money. You gain confidence. Clarity. Control. And most of all: freedom.

Ready to take the first step? Learn how to trade properly and take back control of your financial future, on your terms.