The Best Traders Master Themselves Before They Master the Market

Have you ever found yourself second-guessing every trade? One week, you’re confident; the next, you’re wondering if you’re cut out for this at all. You’re not alone. Many traders and investors hit that point. Not because they lack potential, but because they don’t have a clear roadmap to follow. Not just a set of rules or guardrails, but a full path that shows what stage they’re in, what’s coming next, and how to level up with intention.

The truth is, mastering trading is about how you trade: it’s about the decisions you make constantly, the habits you build day by day, and the discipline you bring when things get tough. Those actions map your journey. That’s what takes you from unsure and reactive to confident and in control.

Like martial arts, trading is something you grow into through levels. You don’t become a black belt overnight. You train. You mess up. You adjust. You improve. That’s exactly what the 8 Trading Belts are about. Advancing through the belts requires developing a combination of abilities, such as analytical thinking, emotional discipline, and adaptability. They give you a way to see where you are, what’s holding you back, and what needs to happen for you to move forward.

This guide is designed for traders who are committed to achieving long-term growth. Whether you’re new to the market or have years of experience but no consistency, this article will help you understand what real progress looks like and how to achieve it. By following a clear roadmap built on structure, discipline, and self-awareness, you’ll learn how to trade with confidence, reduce emotional decision-making, and steadily level up your skills.

Why How You Trade Matters More Than What You Trade

Many people believe the secret to trading success is finding the perfect stock or the next hot trend. But that’s not what makes someone a great trader. The truth is, how you trade is more important than what you trade.

That means your mindset, your trading plan, and your daily habits matter more than trying to predict asset prices. Even in the best financial markets, if your process is broken, you will struggle.

Successful traders don’t just react to changing market conditions. They follow tested systems, stay consistent, and manage their emotions. They focus on execution, not guessing. Developing the ability to analyze markets and control emotions is essential for long-term trading success. These principles are just as important for individuals trading independently as for those trading within a company environment.

So instead of looking for shortcuts, focus on developing strong habits and emotional discipline. The rest will follow.

Belt-by-Belt Breakdown

Here’s the full breakdown of each trading belt, showing what stage you’re in, the common traps to watch for, and what steps you need to take to level up.

1. White Belt: The Beginner — Influenced by Noise

You’re just starting out. Everything feels new. You may follow tips on social media, watch random videos, or jump from one stock to another without a clear plan. Trades are based on emotion, news, or guesswork. Fear and the constant influx of new information can easily overwhelm you, leading to impulsive decisions.

Falling for hype, overtrading, chasing quick profits, and ignoring risk. There’s no trading journal or structured learning.

Stop trading real money. Start learning the basics of trading psychology, risk, and systems. Take advantage of free resources and introductory courses to build foundational knowledge. Read beginner-friendly material and take notes. Watch how markets move and begin recording your thoughts in a journal. Learn to slow down and observe before acting.

2. Yellow Belt: Learning, but Still Subjective

You’ve started studying. You know some terms, maybe even a few strategies. But your decision-making still depends on feelings or external advice rather than rules.

Switching strategies too often, relying on instincts, ignoring stop-losses, and failing to develop self-control.

Choose one strategy to focus on. Start a trading plan. Write down entry and exit ideas and review your trades weekly. Begin working on discipline by sticking to one decision-making process. For example, always follow a specific entry rule for every trade, regardless of market noise. Practice mindfulness to strengthen emotional discipline.

3. Orange Belt: Analysis Overload, Skill Gaps

You’re digging deep into analysis. You know indicators, trends, and patterns, and are developing strong analytical skills for data analysis and market research. But over-reliance on your analytical skills can lead to indecision. The more you learn, the more unsure you feel.

Getting stuck in research mode, not placing trades, or changing tools too often. Mistaking knowledge for experience.

Focus on execution. Use a simulator if needed. Practice placing trades with a clear reason. Set rules for entries and exits based on indicators and stick to them. Track outcomes. Start reviewing your trades like a coach. Consider specializing in a specific type of securities, such as stocks or bonds, to deepen your market analysis and refine your trading strategies.

4. Green Belt: Planning, but Not Objective

You have a basic trading plan, and you’re logging your trades. But your plan is vague or flexible. You bend your rules when emotions get involved.

Breaking rules when trades go against you. Doubting the plan during tough times. Letting emotions guide decisions.

Make your plan stricter. Define every rule in detail: entry signals, exit signals, stop-loss levels, and position size. Practice following it without exception. Keep a detailed log of every trade, including the date of each trade, to identify patterns and improve objectivity. Begin paper trading if needed to develop the habit.

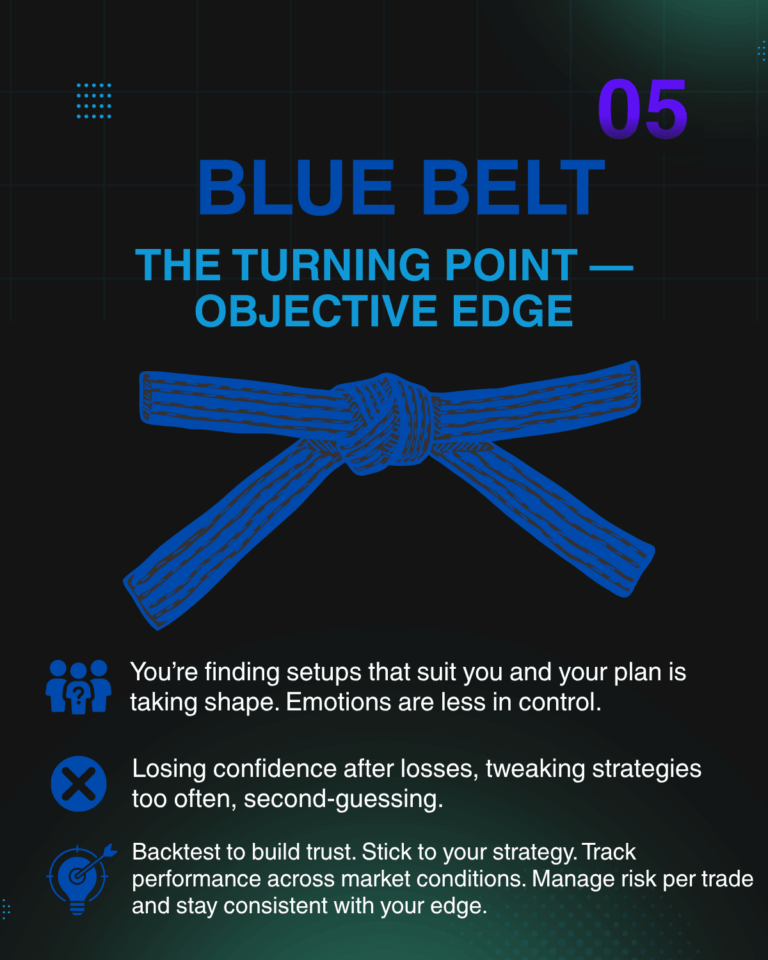

5. Blue Belt: The Turning Point — Objective Edge

You’re starting to find setups that work for you, with a focus on identifying those that lead to more profitable trades. Your trading plan is evolving into something more structured. You rely less on emotion and more on logic.

Losing trust in your system after a few losing trades. Over-adjusting strategies too quickly. Doubting yourself.

Backtest your plan to build belief in it. Commit to tracking trades without changing too much, too fast. Study how your strategy performs in different market conditions. Practice sticking to your edge. Carefully assess the amount you are risking on each trade and ensure it aligns with your overall risk management strategy.

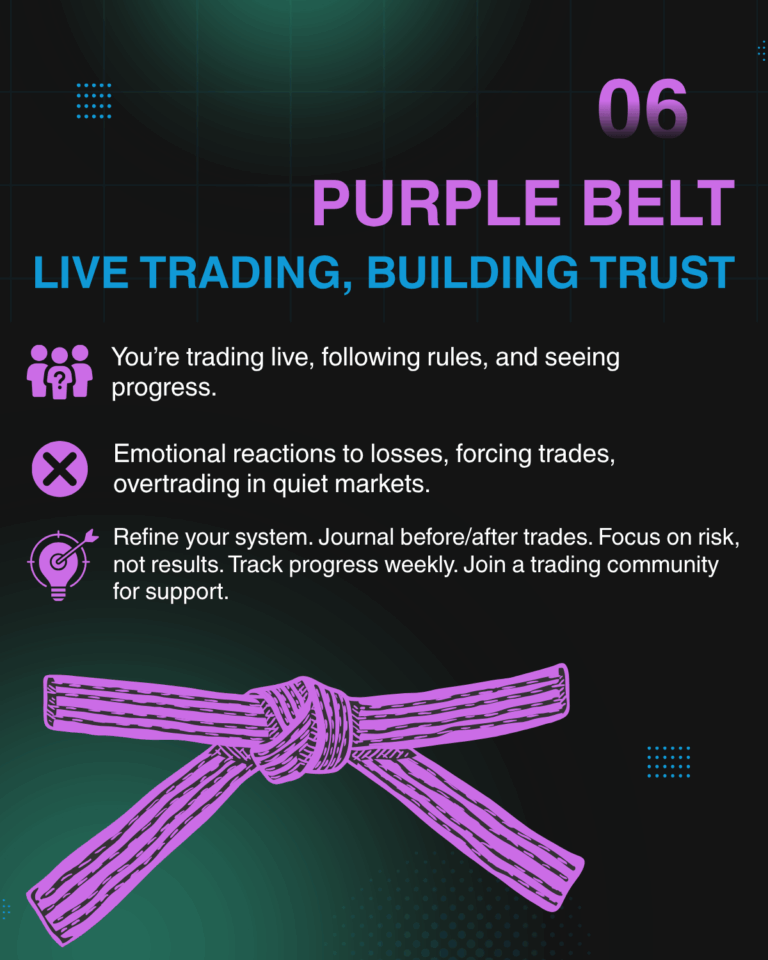

6. Purple Belt: Live Trading, Building Trust

You’re now trading live and following your rules more consistently. You trust your strategy and start seeing progress.

Letting bad trades affect your emotions. Trying to force trades when setups aren’t there. Overtrading during flat markets.

Keep refining your system. Journal your thoughts before and after each trade. Focus on managing risk. After each trade, review and understand the risks involved and how you managed them. Don’t look at daily results. Measure your success over weeks or months. Join a community for support and accountability.

7. Brown Belt: Consistency Across Conditions

You follow your plan well, even during volatile periods. You’re focused more on process than profit. Your emotions are more stable.

Getting bored or complacent. Taking shortcuts. Ignoring your trading journal because things are going well.

Review your performance monthly. Keep logging trades and identifying small improvements. Maintain a detailed record of your trades to track consistency and identify areas for improvement. Don’t let success lead to sloppiness. Push yourself to stay sharp during all market conditions.

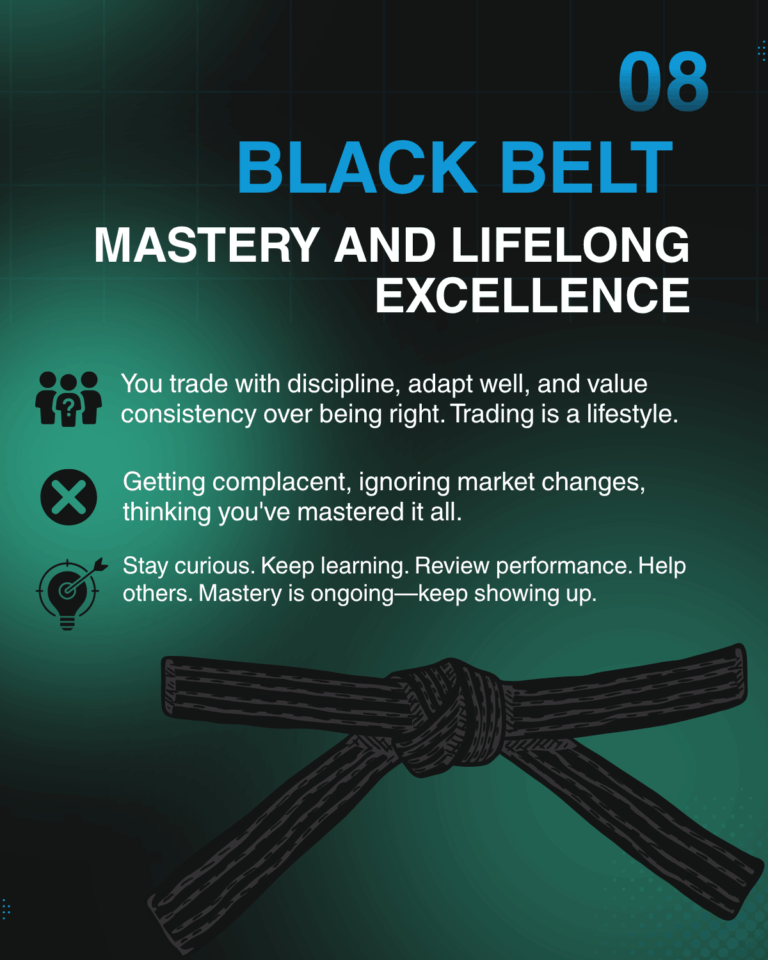

8. Black Belt: Mastery and Lifelong Excellence

Your habits are locked in. You trade calmly and adapt to changing conditions like an experienced trader. You are committed to continuous learning and growth. You understand that consistency is more important than trying to be right all the time. Trading is now part of your life, not just a hobby.

Losing curiosity. Refusing to adapt when the market shifts. Thinking you have nothing left to learn.

Stay humble. Keep learning. Help others. Review your performance regularly. Reflect on your growth. Accept that mastery is a moving target, and keep showing up with focus, patience, and a learner’s mindset.

How to Advance: Structured Training, Feedback, and Coaching

Reading books and watching videos can help, but they only take you so far. To grow faster and avoid years of trial and error, you need a structured environment for skill-building.

The SPA3 Investor System is a mechanical, rules-based investment method developed through over 5,000 hours of research. It was designed specifically for self-directed traders who want consistency, confidence, and a tested edge. Rather than relying on emotions or market predictions, traders follow a clear set of objective rules for each trade.

Any certification or assessment related to the SPA3 Investor System is conducted under relevant industry standards and legal provisions.

How it Works:

This system is tailored for swing trading, not day trading. Positions typically last between 76 and 140 days, focusing on larger trends rather than daily noise. You manage your portfolio using your preferred online broker. When a buy signal is triggered, you enter the trade. When a sell signal is issued, you exit. These signals are provided via the SPA3 Investor Alerts App and the Beyond Charts platform.

SPA3 incorporates volatility-adjusted trailing stops, meaning it adapts to how each stock moves, allowing for smart exits that help lock in gains while limiting downside. In times of high market volatility, the system can even have your portfolio 100% in cash, protecting your capital when needed.

The expected outcome? An annualized return of 5% above the ASX200 Accumulation Index over a five-year rolling period, all while taking on similar risk to a managed balanced fund, as measured by maximum drawdown.

But the real value of SPA3 goes beyond numbers. It acts as a structured training ground for developing objective, repeatable trading habits. As Mark Douglas said in Trading in the Zone, “The mechanical stage of trading is specifically designed to build the kind of trading skills (trust, confidence, and thinking in probabilities) that will virtually compel you to create consistent results.”

With SPA3, you practice execution discipline, learn to trust a system, and eliminate emotional decision-making. It takes less than an hour a week to operate, but the skills you gain can last a lifetime.

Practical Tips to Keep Progressing

No matter where you are on the belt ladder, these tips will help you keep improving:

- Focus on one method and learn it deeply. Don’t jump between five different strategies.

- Keep a trading journal. Write down your reasons for entering and exiting each trade.

- Find an accountability partner or mentor to give you feedback and support.

- Don’t chase the market. Master your process.

- Accept uncertainty. Not every trade will work, and that’s okay.

- Every trader will lose at times. Learning from your losses is essential for growth and long-term success.

- Greed can lead to impulsive decisions and cause you to deviate from your trading plan. Managing this emotion is crucial to maintain a rational approach.

- A disciplined trader follows a defined strategy, maintains emotional control, adheres to risk management principles, and is patient during market fluctuations.

- Keep learning, but don’t forget to apply what you learn through practice.

- Use charts to study trends, price action, and how technical indicators work in real conditions.

Conclusion: The Journey is the Destination

Trading is not about finding a secret shortcut or guessing what markets will do next. It’s about building the right habits, staying focused, and showing up every day with the same level of discipline and self-control.

Every step forward, from White Belt to Black Belt, brings more clarity and confidence. With the right structure, tools like SPA3, and support from a community, you can turn trading into a successful and rewarding journey.

The best traders don’t just know the markets. They master themselves.