How One Investor Transformed His Results with a 100% Mechanical System: The KDA Case Study

Overview: This case study shows how a long-term investor named KDA improved his results by switching from speculative decisions to a fully mechanical system. He moved away from fear-based trading and emotional reactions and learned how anger disrupts your trading rhythm. By following verified signals, he gained a real trading edge and finally achieved consistency […]

How Anger Disrupts Your Trading Rhythm (And What To Do About It)

Anger can break your trading rhythm faster than any market move, pushing you into impulsive decisions that ignore your rules. This article explains how anger affects your brain, why it disrupts execution, and how a simple reset routine can keep you calm, mechanical, and consistent. Learn the habits that protect your edge when emotions spike.

How David L. Overcame Fear-Based Trading Using a Structured Mindset & Process

David L.’s journey shows how fear can undermine even skilled investors. Through a structured Mindset and Process Program, he shifted from hesitation to disciplined, confident execution. This case study highlights how psychology and process can transform trading results.

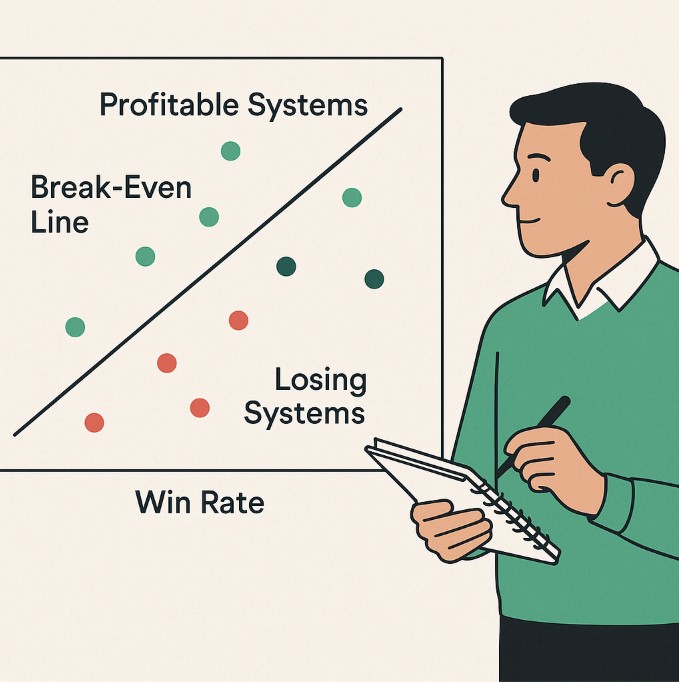

Trading Edge 101: Find Your Break-Even Line

A trading edge isn’t about winning every trade it’s about having probabilities on your side. This article explains the break-even line, expectancy, and the psychology needed to turn a small edge into long-term consistency.

Case Study: How Ron B. Transformed His Trading Consistency After 20 Years of Struggle

After 20 years of over-analysis, system-hopping, and inconsistent results, Ron B. finally transformed his trading through structured coaching and mindset training. By embracing mechanical execution, backtesting, and disciplined habits, he now trades with calm confidence and is preparing to scale his strategy. His journey shows how psychology, not more analysis is the real key to long-term consistency.

Build or Buy? How to Trade With a Verified System That Creates Your Edge

Trading without a verified system leads to stress and inconsistent results. This article explains why every trader needs a proven edge and whether it’s better to build one or adopt an existing, trusted system.

How Allan B. Achieved Profitability With a Backtested Trading System

Allan B’s journey shows what happens when a trader stops chasing strategies and commits to a proven, backtested system. By embracing SPA3, strengthening his mindset, and following rules with discipline, he turned years of inconsistency into a 30% account growth within months. His story is a reminder that structure, simplicity, and long-term thinking are what truly drive profitability.

The Trading Edge: Preparation, Process & Performance

Most traders focus on outcomes, but the real edge comes from preparation. Building systems, habits, and routines that keep you steady through wins and losses. This article explains how trading mirrors endurance sports: those who prepare endure, adapt, and outperform. With the right process, consistency becomes your strongest advantage.

Atomic Habits Meets Trading: Why Consistency Outperforms Predictions

This article shows how simple, repeatable habits paired with a rules-based system create consistency, reduce stress, and let probabilities work in your favor. Think “Atomic Habits” applied to trading: small steps that compound into lasting success.

The Confidence Paradox: Why Uncertainty Is No Barrier to Great Trading

Confidence in trading isn’t about predicting every move, it’s about trusting your process and executing consistently, even through losses. This article breaks down how preparation, tested rules, and a focus on probabilities help traders build real confidence that sustains them long term.