SPA3 Investor

A Rules-Based Investment System

SPA3 Investor operates mechanically, using predefined rules instead of human judgment.

Designed for Full Market Cycles

It stays invested during uptrends and methodically removes capital when markets turn down.

- A proprietary adaptive ATR Trailing Stop that adjusts to volatility

- Swing chart price patterns that trigger exits before major damage occurs

- Fully mechanical buy and sell signals with no interpretation required

How SPA3 Investor Works

SPA3 Investor uses objective market timing rules programmed directly into the Beyond Charts platform

The result is a system that aims to:

- Capture growth and dividends in uptrends

- Move capital to safety during major bear markets

- Reduce drawdowns that destroy long-term confidence

If the signal is there, you act.

If it isn’t, you don’t.

Once set up, the system tells you:

- What to buy

- When to buy

- When to exit

- How much to allocate

Designed for Real Investors, Not Traders

SPA3 Investor is built for people who want results without complexity:

- Suitable for portfolios from $20,000 to $5M+

- Works across ASX and U.S. stocks & ETFs

- Ideal for pre-retirement and retirement investors

- No day trading, no screens, no stress

Everything Is Built In

You don’t need to build anything yourself.

- SPA3 Investor includes:

- Pre-configured watchlists

- Automated scans for entries and exits

- One-click trade execution via Portfolio Manager

- Clear documentation and education pathways

You follow the process. The system handles the logic.

Who SPA3 Investor Is For

- Investors who want growth without catastrophic losses

- Those approaching or in retirement

- Time-poor professionals who want structure

- Anyone tired of emotional decision-making

- Not for gamblers

- Not for day traders

- Not for people who ignore rules

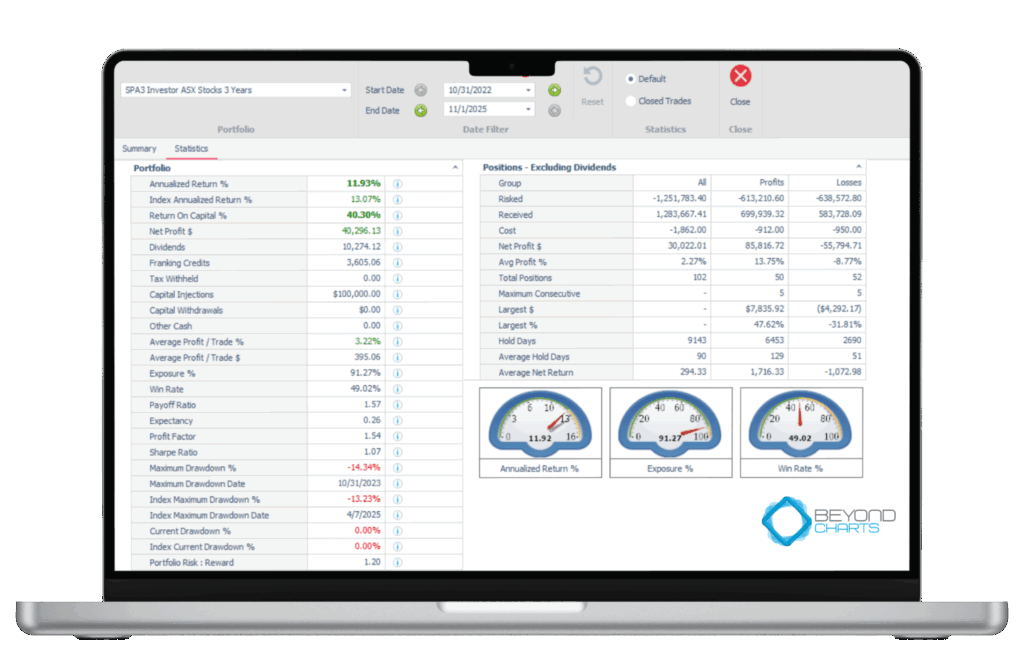

ASX Stocks - SPA3 Investor Equal Weighted Simulation

(with $9.50 brokerage fee and 9 positions 100K)

October 31, 2022 to November 1, 2025

Performance vs Market

- Annualized return: 11.93% vs 13.07% (index) → index ahead by ~1.1%/yr.

- Total gain (ROC): +40.30% → $140,296 end value (incl. dividends/franking).

- P&L mix: Trading P/L (ex-div): $30,022 + Dividends: $10,274 + Franking credits: $3,605.

Risk/Drawdown (what actually breaks traders)

- Max drawdown: −14.34% (31 Oct 2023) vs index −13.23% (7 Apr 2025).

- Risk : Reward (DD per unit return): 1.20 vs index 1.01 → slightly more “pain per return” than buy-and-hold in this slice.

- Average exposure: 91.27% (mostly invested).

Edge Mechanics (why the math works)

- Win rate: 49.02%.

- Payoff ratio: 1.57 (avg win +13.75%, avg loss −8.77%).

- Expectancy: +0.26R per trade; Profit factor: 1.54.

- Avg per trade: +3.22% or +$395.

- Hold time: 90 days on avg; winners held 129 days, losers 51 → trend-following signature.

Trade Distribution (whole window)

- Total positions: 102 (50 wins / 52 losses).

- Largest win / loss: +$7,836 (+47.6%) / −$4,292 (−31.8%).

- Streaks: up to 5 wins or 5 losses consecutively (from table).

- Current DD: 0% → equity at/near a high at the end date.

This 3-year stretch favored buy-and-hold a touch. SPA3 still delivered a double-digit CAGR (+11.9%), with controlled drawdown (−14.3%), positive expectancy, and a healthy dividend + franking boost (~$13.9k, ~34% of total profit).

The edge remains the same: cut losses, let winners run longer, take every signal. You won’t outrun the index every slice—but you stay in the game with defined risk and let the math compound.

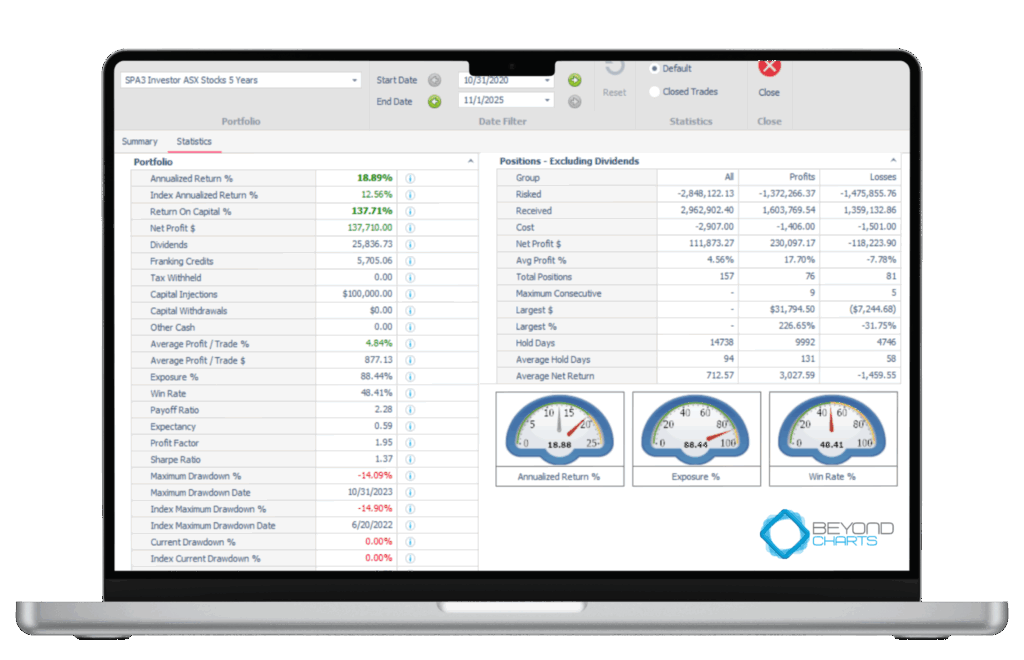

October 31, 2020 to November 1, 2025

Performance vs Market

- Annualized return: 18.89% vs 12.56% (index) → ~+6.3%/yr edge.

- Total gain (ROC): +137.71% → end value ≈ $237,710 (incl. income).

- P&L mix: Trading P/L (ex-div): $111,873 + Dividends: $25,837 + Franking: $5,705.

Risk/Drawdown (what actually breaks traders)

- Max drawdown: −14.09% (31 Oct 2023) vs index −14.90% (20 Jun 2022).

- Risk : Reward (DD per unit return): 0.75 vs index 1.19 → better pain-for-gain than buy-and-hold in this 5-yr slice.

- Average exposure: 88.44% (mostly invested, but not all-in).

Edge Mechanics (why the math works)

- Win rate: 48.41% (about half).

- Payoff ratio: 2.28 (avg win +17.70%, avg loss −7.78%).

- Expectancy: +0.59R per trade (strong).

- Profit factor: 1.95.

- Avg per trade: +4.84% or +$877.

- Hold time: 94 days on average; winners 131 days vs losers 58 → classic trend signature (let winners run longer).

Trade Distribution (whole window)

- Total positions: 157 (76 wins / 81 losses).

- Largest win / loss: +$31,795 (+226.7%) / −$7,245 (−31.8%).

- Streaks: up to 9 wins or 5 losses consecutively.

- Average net per trade: $713; wins $3,028, losses −$1,460.

You outpaced the index decisively with lower pain per unit of return. The engine is clear: roughly half your trades win, but winners are ~2.3× the size of losers and are held much longer.

That’s a +0.59R edge—big enough to compound without drama, provided you keep doing the boring work: take every signal, cap losses, never negotiate with exits.

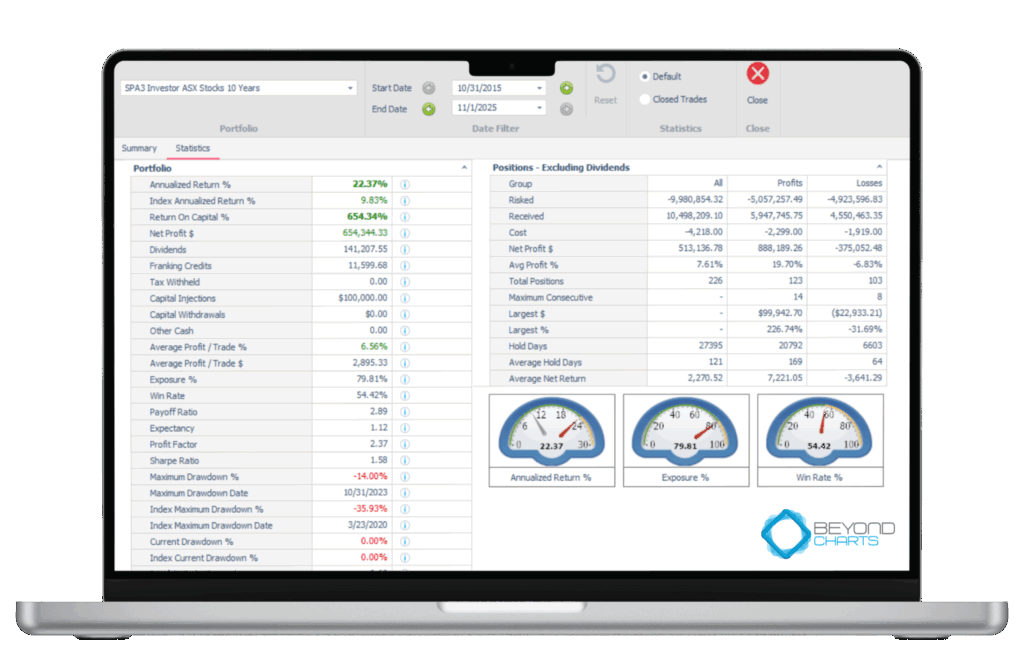

October 31, 2015 to November 1, 2025

Performance vs Market

- Annualized return: 22.37% vs 9.83% (index) → ~+12.5%/yr edge.

- Total gain (ROC): +654.34% → end value ≈ $754k from $100k (ex-franking).

- P&L mix: Trading P/L (ex-div): $513,137 + Dividends: $141,208 (Net Profit: $654,344) Franking credits: $11,599 (reported separately).

Risk/Drawdown (what actually breaks traders)

- Max drawdown: −14.00% (index −35.93%).

- Risk : Reward (DD per unit of return): 0.63 vs index 3.65 → far less pain per return.

- Average exposure: 79.81% (not perpetually all-in).

Edge Mechanics (why the math works)

- Win rate: 54.42%.

- Payoff ratio: 2.89 (avg win +19.70%, avg loss −6.83%).

- Expectancy: +1.12R per trade (excellent).

- Profit factor: 2.37.

- Avg per trade: +6.56% or +$2,895.

- Avg hold: 121 days; winners 169 vs losers 64 → winners ride ~2.6× longer.

- Largest win / loss: +$99,943 (+226.7%) / −$22,933 (−31.7%).

Trade Distribution (whole window)

- Total positions: 226 (123 wins / 103 losses).

- Streaks: up to 14 wins and 8 losses in a row.

- Avg net per trade: $2,271 (wins $7,221; losses −$3,641).

You crushed the index over 10 years, compounding to ~7.5× while taking far smaller drawdowns. The engine is textbook SPA: just over half the trades win, but winners are ~3× the size of losers and are held much longer—driving a +1.12R expectancy.

Keep doing the boring, professional work: take every signal, cut losses, let winners run.

(period and market specific; past performance isn’t a guarantee of future results)

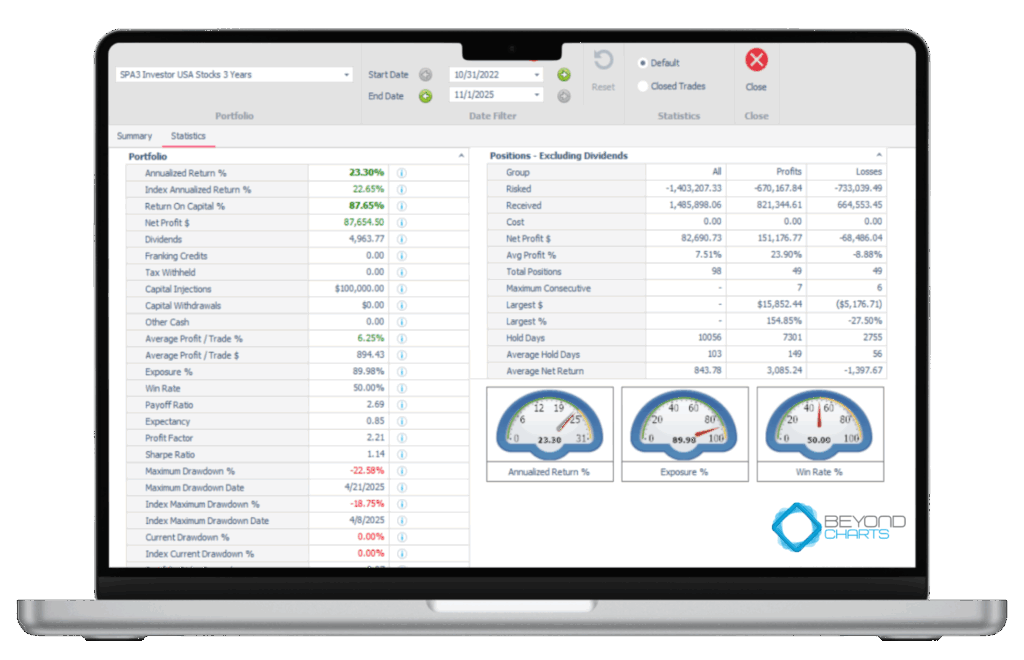

USA Stocks - SPA3 Investor Equal Weighted Simulation

(10 positions with no brokerage fee 100K)

October 31, 2022 to November 1, 2025

Performance vs Market

- Annualized return: 23.30% vs 22.65% (index) → ~+0.65%/yr edge.

- Total gain (ROC): +87.65% → end value ≈ $187,654.

- P&L mix: Trading P/L (ex-div): $82,690 + Dividends: $4,964 = $87,655 net.

Risk/Drawdown (what actually breaks traders)

- Max drawdown: −22.58% (index −18.75%) — you took a bit more heat in this slice.

- Risk:Reward (DD per unit return): 0.97 vs index 0.83.

- Average exposure: 89.98%; current DD: 0% (ending near highs).

- Now: 10/10 positions on; ~99.5% invested (from Summary); open profit at risk ~$18.96k with a few thousand locked by stops.

Edge Mechanics (why the math works)

- Win rate: 50.00%.

- Payoff ratio: 2.69 (avg win +23.90%, avg loss −8.88%).

- Expectancy: +0.85R per trade (0.5×2.69 − 0.5×1).

- Profit factor: 2.21; Sharpe: 1.14.

- Avg per trade: +6.25% or +$894.

- Hold time: 103 days on avg; winners 149 days vs losers 56 → winners ride ~3× longer.

Trade Distribution (whole window)

- Total positions: 98 (49 wins / 49 losses).

- Largest win / loss: +$15,852 (+154.9%) / −$5,177 (−27.5%).

- Streaks: up to 7 wins and 6 losses consecutively.

In a strong U.S. tape, SPA3 kept up and slightly edged the index while running a solid +0.85R expectancy. You took more drawdown than buy-and-hold at times, but the engine is clean: half the trades win; winners are ~2.7× the losers and held ~3× longer.

Keep doing the boring work: take every signal, cut quickly, let trends pay.

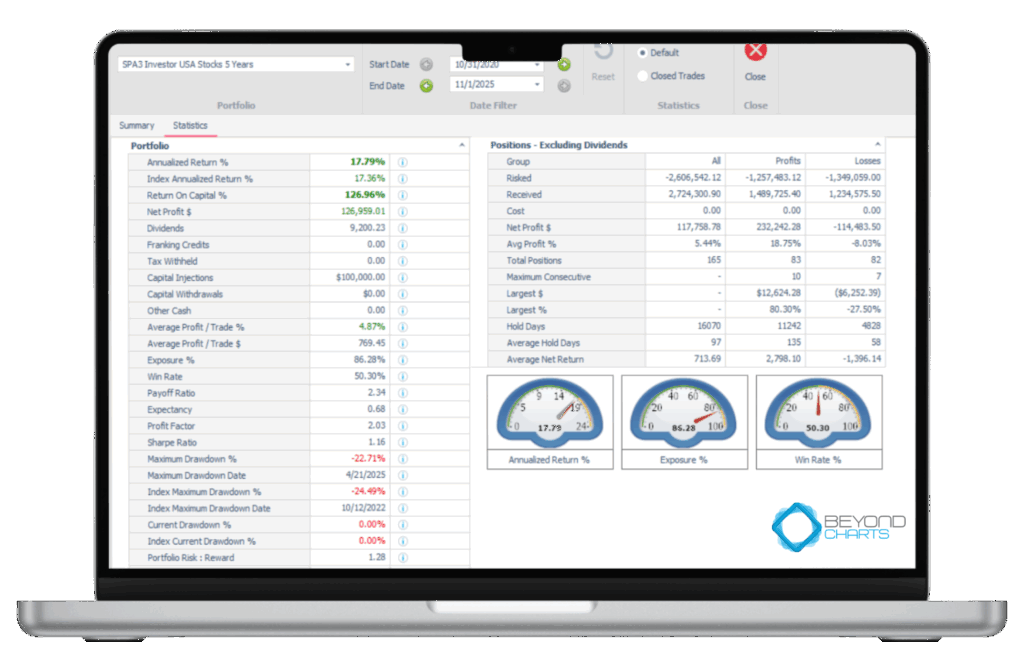

October 31, 2020 to November 1, 2025

Performance vs Market

- Annualized return: 17.79% vs 17.36% (index) → ~+0.43%/yr edge.

- Total gain (ROC): +126.96% → end value ≈ $226,959.

- P&L mix: Trading P/L (ex-div): $117,758.78 + Dividends: $9,200.33 = Net profit $126,959.01.

Risk/Drawdown (what actually breaks traders)

- Max drawdown: −22.71% vs index −24.49% → slightly shallower pain.

- Risk : Reward (DD per unit return): 1.28 vs index 1.41 (better).

- Average exposure: 86.28%; current DD: 0.00% (finished near highs).

Edge Mechanics (why the math works)

- Win rate: 50.30%.

- Payoff ratio: 2.34 (avg win +18.75%, avg loss −8.03%).

- Expectancy: +0.63R/trade.

- Profit factor: 2.03; Sharpe: 1.16.

- Avg per trade: +4.87% or ≈$769.

- Hold time: 97 days average; winners 135 days vs losers 58 → winners ride ~2.3× longer.

Trade Distribution (whole window)

- Total positions: 165 (83 wins / 82 losses).

- Largest win / loss: +$12,624 (+80.3%) / −$6,252 (−27.5%).

- Streaks: up to 10 wins and 7 losses consecutively.

- Avg net return (ex-div): $713.69 (wins $2,798; losses −$1,396).

You kept pace with a strong U.S. market and edged it with less pain per unit of return. The engine is clean: about half the trades win, but winners are ~2.3× the losers and are held much longer. That’s a +0.63R expectancy—good enough to compound so long as you keep doing the boring, professional work: take every signal, cut quickly, never negotiate exits.

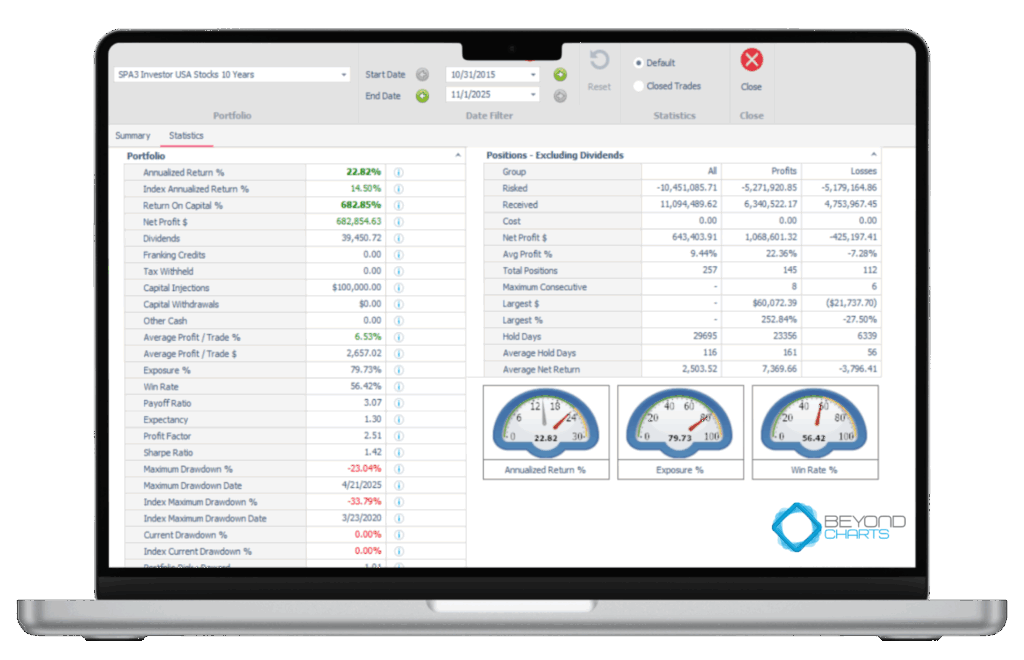

October 31, 2015 to November 1, 2025

Performance vs Market

- Annualized return: 22.82% vs 14.50% (index) → ~+8.3%/yr edge.

- Total gain (ROC): +682.85% → end value ≈ $782,855.

- P&L mix: Trading P/L (ex-div): $643,404 + Dividends: $39,451 = Net profit: $682,855.

Risk/Drawdown (what actually breaks traders)

- Max drawdown: −23.04% vs index −33.79% → shallower pain than buy-and-hold.

- Risk : Reward (DD per unit return): 1.01 vs index 2.33 → ~2.3× better pain-for-gain.

- Average exposure: 79.73%; current DD: 0.00% (finished near highs).

Edge Mechanics (why the math works)

- Win rate: 56.42%.

- Payoff ratio: 3.07 (avg win +22.36%, avg loss −7.28%).

- Expectancy: +1.30R per trade (excellent).

- Profit factor: 2.51; Sharpe: 1.42.

- Avg per trade: +6.53% or $2,657.

- Hold time: 116 days avg; winners 161 vs losers 56 → winners ride ~3× longer.

Trade Distribution (whole window)

- Total positions: 257 (145 wins / 112 losses).

- Largest win / loss: +$60,072 (+252.8%) / −$21,738 (−27.5%).

- Streaks: up to 8 wins and 6 losses consecutively.

- Avg net (ex-div): $2,503 overall; $7,370 wins vs −$3,796 losses.

You turned $100,000 → $682,854.63 (Oct ’15–Nov ’25) with a max DD −23.04% vs the index’s −33.79%, powered by +1.30R expectancy. 56.42% of trades win, winners are ~3.07× losers and are held ~161 vs 56 days.

Keep doing the boring, professional work—take every signal, cut quickly, never negotiate exits.

(period and market specific; past performance isn’t a guarantee of future results)

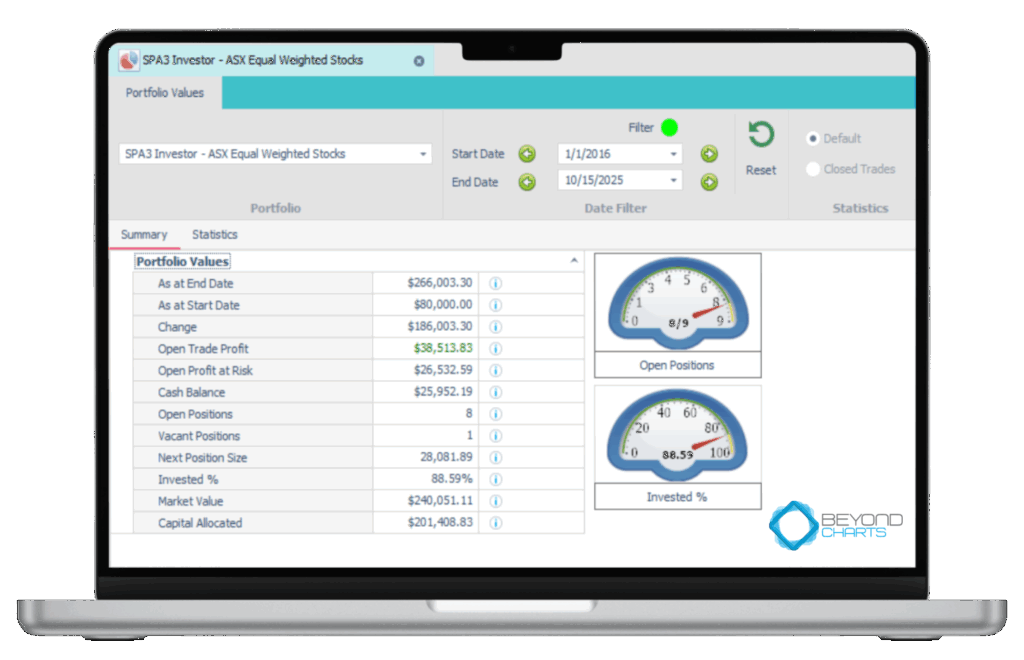

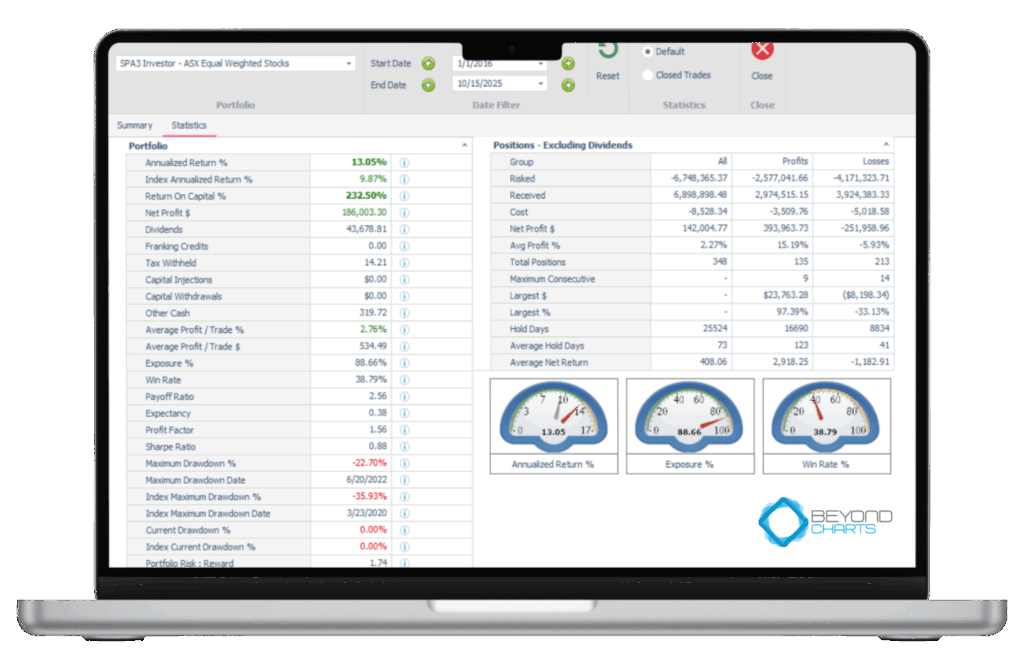

SPA3 Investor Report

ASX Equal-Weighted

(1 Jan 2016 → 15 Oct 2025)

2016–2025 ASX (equal-weight)

SPA3 compounded at 13.05% p.a. vs 9.87% for the index, growing $80k → $266k with a max drawdown of −22.7% (index −35.9%).

As of 15/10/25:

SPA3 positions are filled, ~89% invested, $25.9k cash, $26.5k open profit at risk. Edge intact, risk defined.

From 2016–2025, SPA3 Investor compounded at 13.05% p.a. vs the market’s 9.87%, turning capital into ~3.3× with a shallower drawdown (-22.7% vs -35.9%) a positive-expectancy, rules-based edge built on bigger winners, smaller losers, and disciplined execution.

Performance vs Market

- Annualized return: 13.05% vs 9.87% for the index → ~+3.18%/yr edge.

- Cumulative growth (approx.): System ~3.32× start capital vs Index ~2.51× → ~32% more total growth.

- Return on Capital: 232.5% (ending value ≈ 3.33× starting capital).

- Net profit: $186,003 which = $142,005 trading P/L (ex-div) + $43,679 dividends + $320 other cash.

- Costs (friction): $8,528 absorbed in the above.

Risk/Drawdown (what actually breaks traders)

- Max drawdown (portfolio): -22.70% (index: -35.93%). You took meaningfully shallower pain.

- Risk:Reward ratio: 1.74 vs index 3.64 → you “spent” ~1.74 points of drawdown per 1 point of annual return; the index “spent” more than double.

Edge Mechanics (why the math works)

- Win rate: 38.79% (low is fine when winners are much bigger).

- Payoff ratio: 2.56 (average win ≈ 2.56× average loss).

- Expectancy: 0.38R/trade (math checks: 0.3879×2.56 – 0.6121×1 ≈ +0.38R).

- Profit factor: 1.56 (gross profits are 56% larger than gross losses).

- Average move: +2.76% per trade; $534 per trade.

- Average hold: 73 days; winners held longer (123 days) than losers (41 days) → classic trend-following signature.

- Average invested (exposure): 88.66%.

Trade Distribution (whole window)

- Total positions: 348 (≈ 35/yr).

- Avg winner: +15.19% vs avg loser: -5.93%.

- Largest win: $23,763 (+97.39%). Largest loss: -$8,198 (-33.13%).

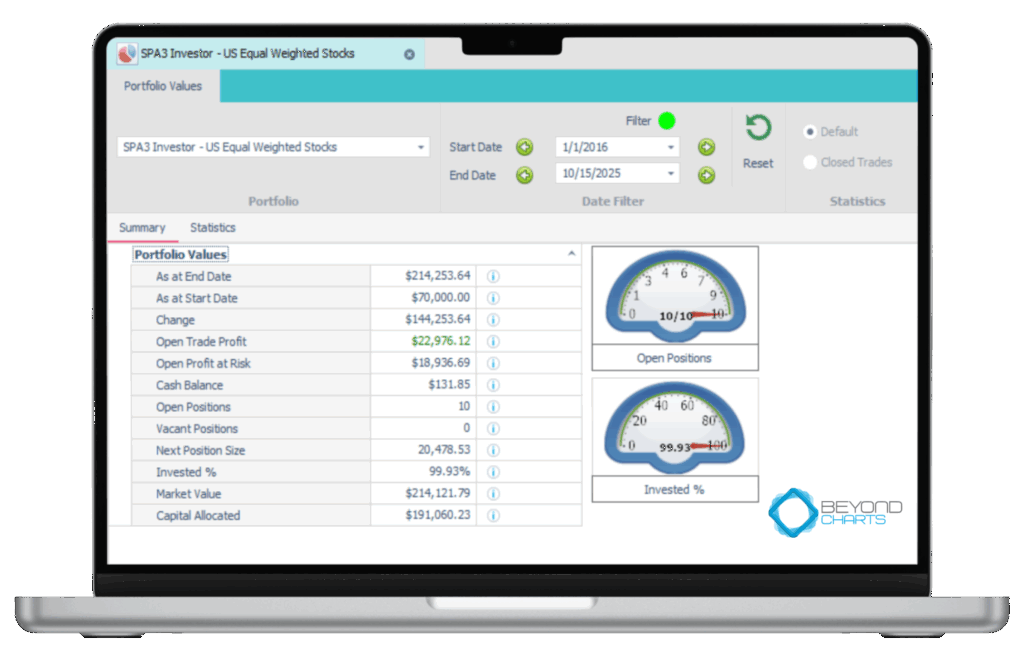

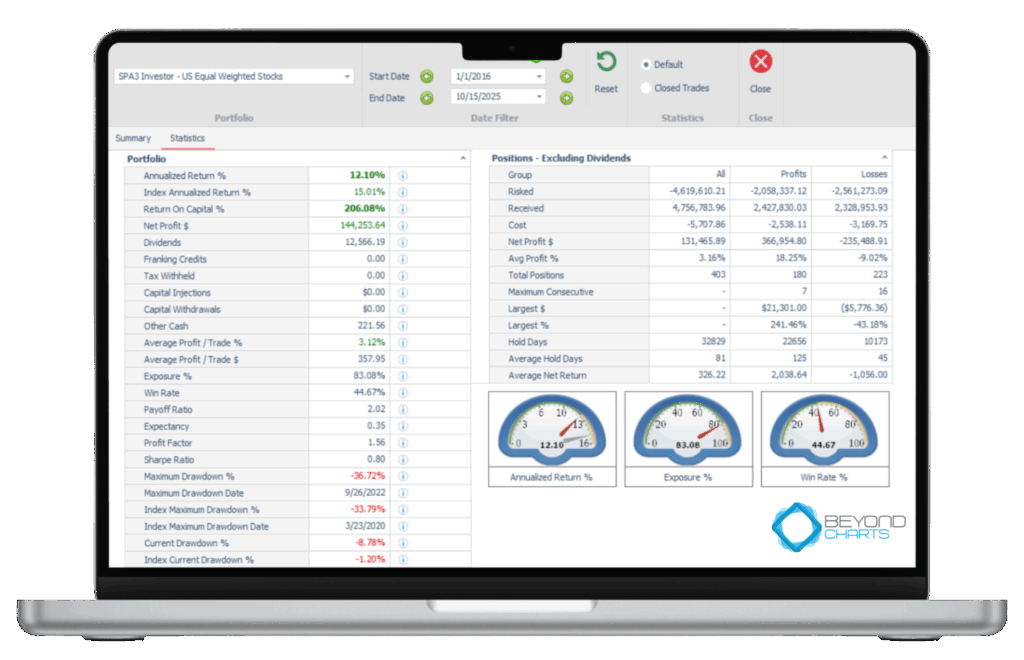

SPA3 Investor

US Equal-Weighted

(1 Jan 2016 → 15 Oct 2025)

2016–2025 US (equal-weight):

SPA3 compounded to $214k from $70k (12.10% p.a.) with a max DD −36.7%; it trailed the index (15.01% p.a.) but maintained a positive-expectancy, rules-based profile.

As of 10/15/2025:

SPA3 has 10 out of 10 Positions, ~100% invested, $22.98k open profit with ~$4k locked by stops. Risk defined, edge intact.

From 2016–2025, SPA3 Investor compounded at 13.05% p.a. vs the market’s 9.87%, turning capital into ~3.3× with a shallower drawdown (-22.7% vs -35.9%) a positive-expectancy, rules-based edge built on bigger winners, smaller losers, and disciplined execution.

Performance vs Market

- Annualized return: 12.10% vs 15.01% (index) → the index outperformed by ~2.9%/yr.

- Cumulative growth (approx.): SPA3 ~3.06× starting capital (ROC 206%); index ~3.9–4.0× over the same window.

- Net profit: $144,253 total = $131,466 trading P/L (ex-div) + $12,566 dividends + $222 other cash.

Trading costs: $5,708 included in the above.

Risk/Drawdown (what actually breaks traders)

- Max drawdown: -36.72% (on 26 Sep 2022) vs index -33.79% (on 23 Mar 2020).

- Current drawdown: -8.78% vs index -1.20% (as of the end date).

- Risk:Reward (drawdown per unit of annual return): 3.03 vs index 2.25 → you “spent” more pain for each point of return here.

Edge Mechanics (why the math works)

- Win rate: 44.67% (180 wins / 403 trades).

- Payoff ratio: 2.02 (avg win +18.25%, avg loss -9.02%).

- Expectancy: +0.35R per trade (0.4467×2.02 − 0.5533×1 ≈ +0.35R).

- Profit factor: 1.56 (profits 56% larger than losses).

- Average per trade: +3.12% or +$358.

- Hold time: 81 days on average; winners held 125 days vs losers 45 → classic trend signature.

- Exposure: 83.08% average invested.

- Largest win/loss: +$21,301 (+241%) / -$5,776 (-43%).

- Streaks: up to 7 winners in a row, 16 losers in a row (you need emotional resilience).

Trade Distribution (whole window)

- Total positions: 403.

- Largest win / loss: +$21,301 (+241%) / −$5,776 (−43%).

- Streaks: up to 7 wins, 16 losses in a row (you need resilience).

(period and market specific; past performance isn’t a guarantee of future results)

Get Started with SPA3 Investor

Feedback From Our Customers