If you’re investing like nearly everybody else (defaulting mostly to balanced funds and 3rd parties), chances are you’re not going to save enough money for a comfortable and self-sufficient 25-30 year retirement.

The above statement isn’t just my opinion. It’s a fact.

If you already know and accept this fact, feel free to skip over to the part of the article that shows you how to adopt a better way of investing. One that skyrockets the chances of you having a financially worry-free retirement. (Just go through the 4 inputs from the next section and skim the Case Study first.)

But if you still think the standard (mutual/managed funds) option is your best bet, at least check out why that might not be the case.

That’s because investing like everyone else is almost guaranteed to create a Retirement Gap. Meaning you won’t be able to enjoy at least the same lifestyle in retirement as when you were working.

Research by HSBC shows that 65% of people only realize that the status quo retirement system is broken AFTER they retire.

And even though it’s never too late to take matters into your own hands and chart a course to a financially safe retirement…

It’s much easier to do so NOW, instead of later, to get the magic of compounding returns working for you ASAP.

If you bear with me today, you’ll not only gain an understanding of how and why the retirement system is broken…

But will also have a clear idea of what you need to do to make this fact irrelevant for your financial well-being.

With that said, let’s dig into it.

Why The Default Retirement System Won’t Help You Ensure A Financially Self-Sufficient Retirement

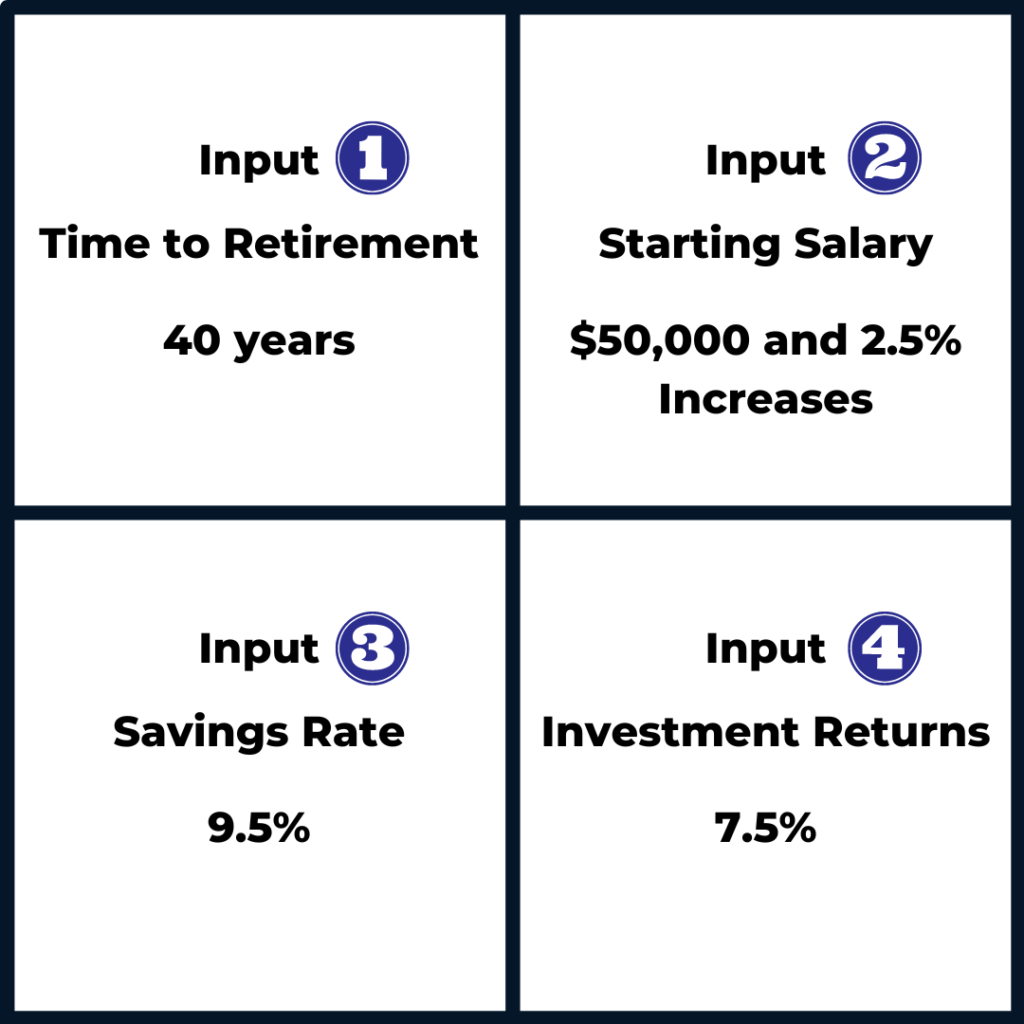

There are ONLY 4 inputs that determine how big your nest egg will be:

- The length of time you save for retirement

- The salary you earn (and its increases over your working life)

- The savings rate (how much you regularly contribute to your nest egg)

- The annualized investment returns you get while working

To ensure a comfortable and self-sufficient retirement, you must find the best possible combination of these 4 inputs.

But the combination the current retirement model creates is far from the best. In fact, it’s virtually a surefire way to create a Retirement Gap with a 40-year working life.

To see how this is possible and understand why the model has failed millions of investors, consider the following case study:

A Case Study That Exposes All The Holes Within The Retirement System

Imagine an Australian named Joe who starts working at 25, for example.

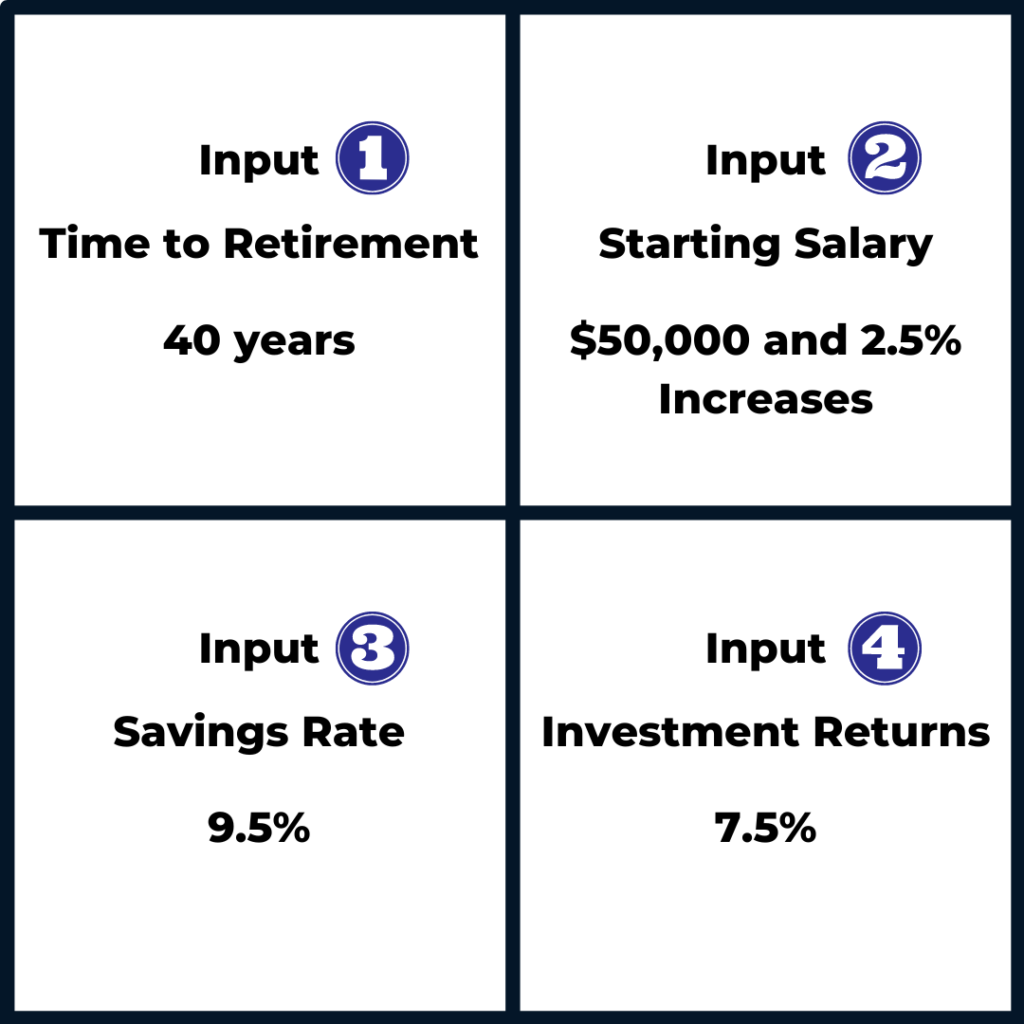

This means 40 years of investing (Saving Time to Retirement – Input 1) lies ahead of him.

During those 40 years, Joe’s employer will contribute 9.5% p.a. (Savings Rate – Input 3) of their salary and annual increases into their retirement savings account (This is gradually increasing to 12% by 2025 in Australia, but read on as 12% won’t be enough anyway).

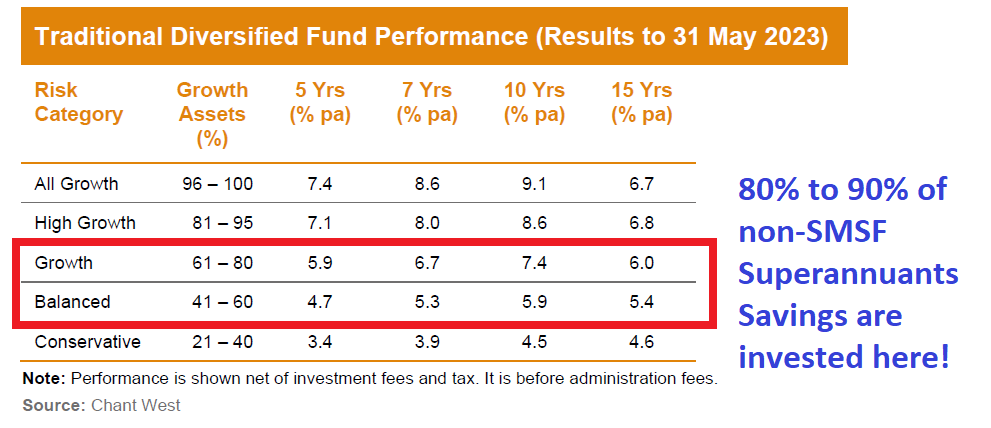

Because Joe invests as per the status quo, he has a nest egg savings account in a typical managed Balanced Fund. And the table below shows such Funds have achieved between 5.0% to 6.0% annualized returns over the past 15 years to 31 May 2023 (Investment Return Rate – Input 4).

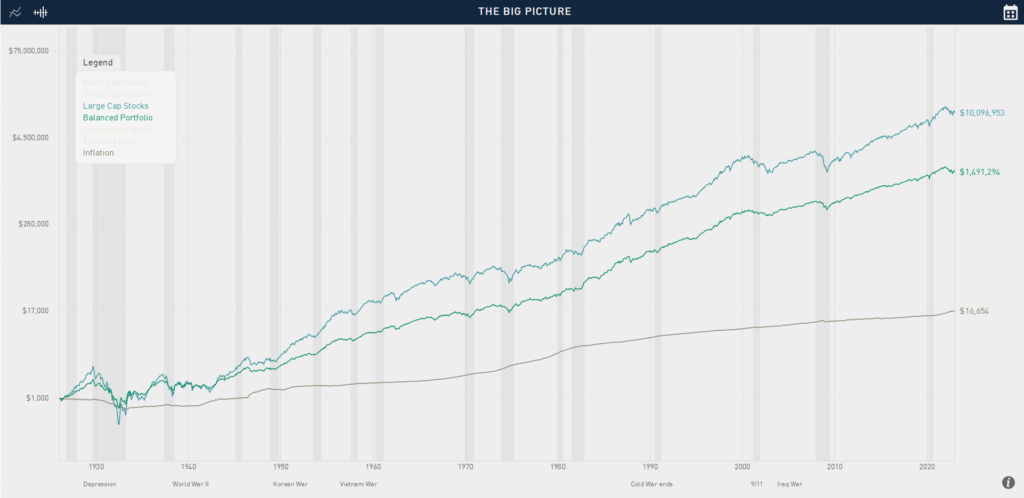

These 15-year returns are very similar to the average returns of Balanced Funds over the past 97 years, as you can see in The Big Picture chart below.

If you had put $1,000 in a Balanced Fund in 1926, you’d have $1,491,294 by 31 May 2023. This represents an annual growth rate of 7.78%.

Note that this return excludes fees over the 97 years of between 0.5% & 2.5% p.a. or more. Meaning the average return is actually closer to 6.9% or less.

But let’s use a best-case scenario growth rate of 7.5% for planning purposes.

Finally, let’s assume that Joe starts off with a $50,000 salary that increases annually along with inflation by 2.5% (Your Salary and its increases – Input 2).

Now that we have all 4 inputs, we can group them in a table and see how they affect the size of Joe’s nest egg:

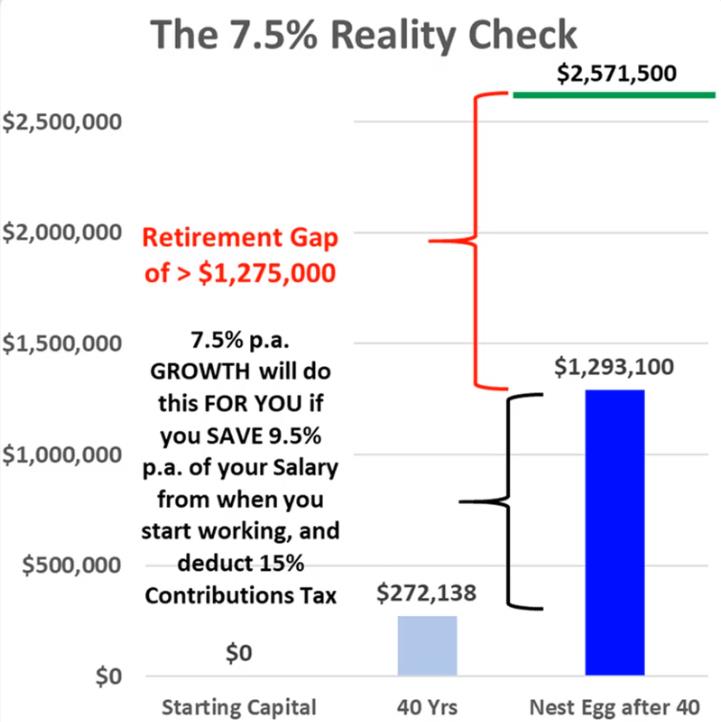

So, to sum up, if Joe starts working at age 25 with a $0 superannuation (nest egg) balance…

And contributes 9.5% of his starting $50,000 salary (which increases by 2.5% each year) to his super fund (nest egg) for 40 years, all the while paying a 15% contributions tax…

And earns a 7.5% annualized return over those 40 years…

He will end up with a retirement nest egg balance of $1,290,882.

How can I claim that such a large number isn’t enough for a self-sufficient retirement?

Well, the ASFA (Australian Superannuation Funds Association) Retirement Standard states that for an individual to enjoy a comfortable and self-reliant retirement…

They need at least $50,004 in annual income. (This number is from March quarter 2023, and it increases every year.)

Now consider that $50,004 in today’s dollars will be $134,264 in 40 years’ time (2063), at an average of 2.5% inflation (source: smart asset inflation calculator).

So to be able to pull an annual income of $134,264 in 40 years’ time, inflated at 2.5% every year for a 22 year retirement, you need to accumulate a lump sum of $2,210,000.

That’s if you want to have enough funds for 22 years of retirement, independent of receiving government pensions, for which they won’t qualify anyway.

Now, the $134,264 sum would be enough for year 1 of your retirement. Then, your income must rise by 2.5% p.a. to cater for inflation of the cost of living. Which in turn means your lump sum would need to grow at 5% p.a. to cover the ongoing 2.5% inflation and the necessary ongoing growth during retirement to meet drawdowns.

I’ve thrown around a lot of numbers, I know. But take a while to let them sink in, and you’ll realize they clearly showcase this truth:

The current default 9.5% & 7.5% Rule of Returns model demonstrated in the Case Study above is broken.

That’s because using it leads to a Retirement Gap of $919,118. That is, you’ll be $919,118 short of what you actually need for a comfortable and self-sufficient retirement.

In other words, if Joe invests as per the 9.5% & 7.5% Rule of Returns and continues to drawdown $50,004 p.a. in 2023 dollars, inflated at 2.5% p.a…

His funds will run out completely in 10-12 years. Then Joe won’t be able to draw anymore, meaning he’ll become completely reliant on family and/or the government.

A similar fate awaits you if you invest as per the same 9.5% & 7.5% Rule of Returns.

Even for higher income earners with bigger nest eggs, because the level of lifestyle to which we’ve become accustomed determines how much income we need in the future. Nobody wants to have to take a step backwards in retirement because they planned poorly while working.

You should also consider that the example above is for an individual. For a couple to enjoy a comfortable retirement in 2023, they need $70,482 according to ASFA. This equates to $189,249 in 40 years time with inflation at 2.5%. Meaning the lump sum required to enjoy a comfortable and self-sufficient retirement that lasts 22 years for a couple is closer to $3,100,000.

Here’s how this fate looks graphically for Joe:

Now, there’s a way to avoid becoming another victim of The 9.5% & 7.5% Rule of Returns.

In a nutshell, it boils down to changing the 4 inputs that determine the size of your nest egg.

Increasing each one can help you bridge the Retirement Gap. But every increase comes with a challenge. So, you must decide which challenge would be easiest for you to overcome.

And in the next section, I’ll do my best to help you make that decision.

How To Skyrocket The Chances Of Enjoying A Financially Worry-Free Retirement Despite The Broken System

As I’ve mentioned, all you need to do is tinker with one or more of the 4 inputs that determine the size of your nest egg. But as I’ve also mentioned, doing so brings forth additional challenges you must overcome.

Here are your options if you want to ensure a self-sufficient retirement and avoid falling prey to the 9.5% & 7.5% Rule of Returns.

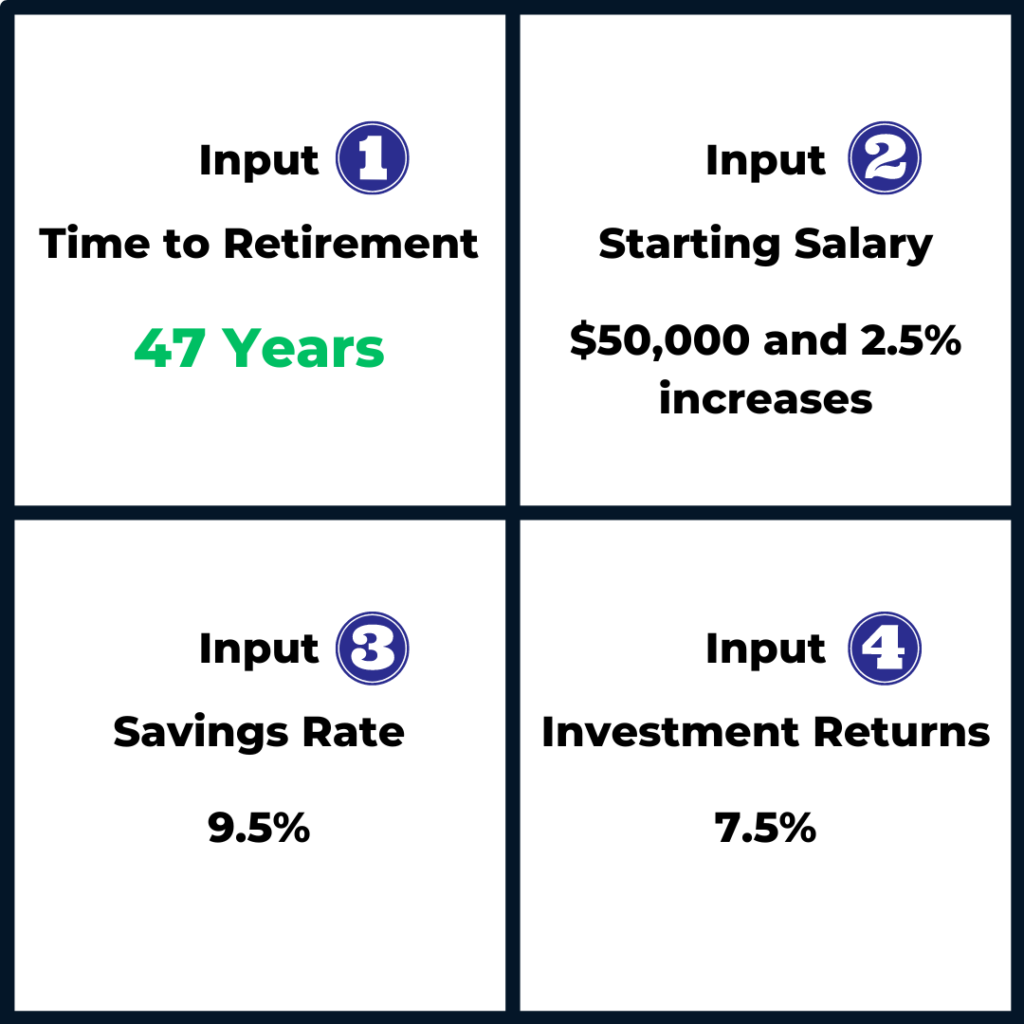

1. Postpone Your Retirement And Work Longer

If you work 7 years more than the standard 40 years, you should have enough funds to bridge the Retirement Gap. Assuming the other 3 inputs remain intact at their default ranges (2.5% annual salary increase, 9.5% savings rate, 7.5% annualized investment returns.)

This is a straightforward solution. But it’s something most people (understandably) want to avoid doing.

Even if you aren’t one of those people, don’t forget about the health risk this option brings. Sometimes working more just isn’t possible no matter how much we want or need it.

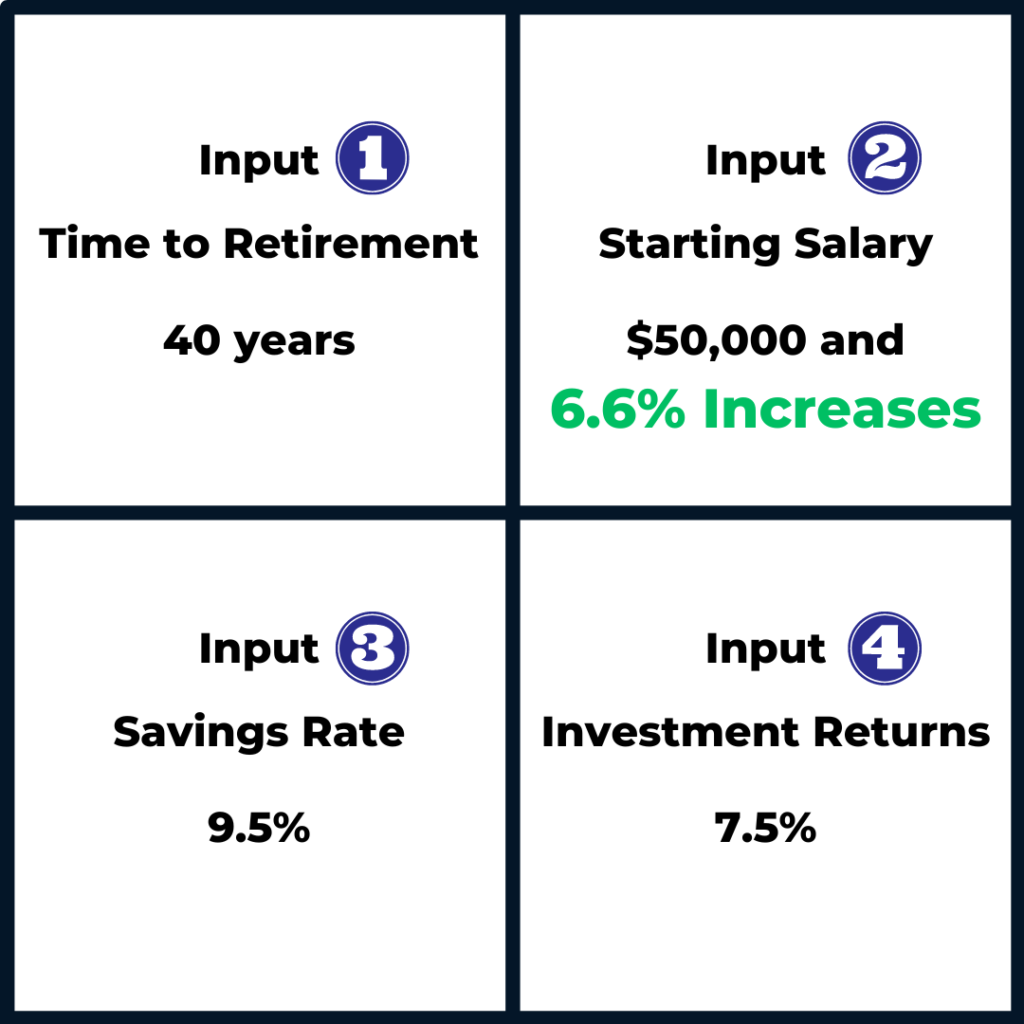

2. Make Sure Your Salary Continuously Increases Far More Than The Norm

This is another straightforward but even harder to achieve solution. That’s because you’d need to have a 6.6% salary increase every year over 40 years with the other inputs intact to bridge the retirement gap (9.5% savings rate, 7.5% annualized investment returns).

If you can devote time & money to acquire new skills and knowledge that can increase your earning potential, this route can work for you.

Most people can do this. But as I’ve said before, it’s far from easy and requires lots of sacrifices on your end.

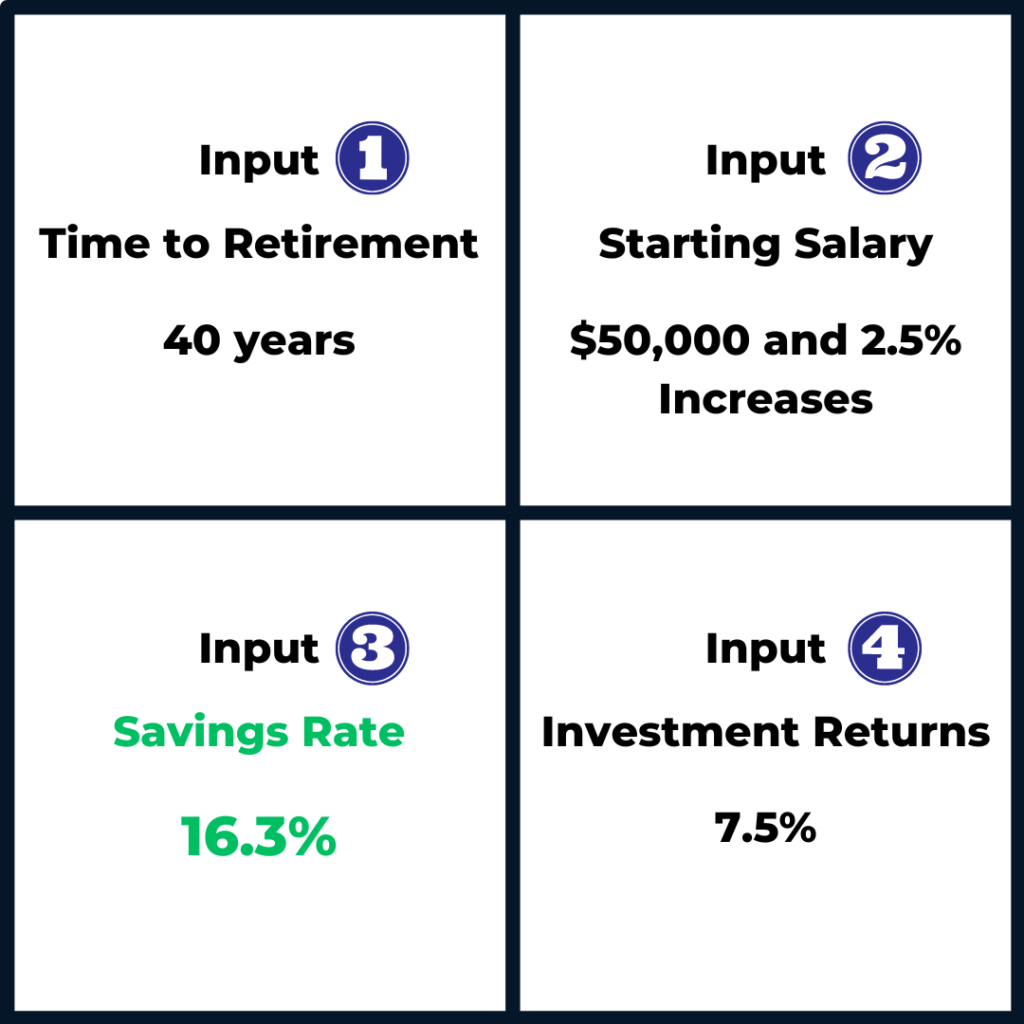

3. Save More From Each Salary

The 9.5% savings rate I mentioned has been more or less the standard in both Australia and the U.S. (This is gradually increasing in Australia to 12% by 2025, but if you’re in your 40s to 60s, it’s not going to help as your average nest egg savings from salary has probably been far less).

But if you can find the mental fortitude to set aside more than that each month and year during your 40-year working life…

You can bridge the Retirement Gap.

More specifically, EVERY YEAR of your working life you’d need to set aside 16.3% in Australia (because of the 15% contributions tax that needs to be paid on superannuation contributions) and 13.85% in the US. Assuming the other 3 inputs remain intact at their default ranges (2.5% annual salary increase, 40-year working life, 7.5% annualized investment returns.)

If you have a “live within your means” mindset, this option will fit you perfectly. But if you’re like most people, you’ll end up spending the difference on both important (e.g., rent for a bigger home, tuition for a better university, etc.) and less important (eating out, longer vacations, etc.) stuff.

4. Take Control Of Your Investing And Increase Your Annualized Returns

In my completely biased (but stock-market investing verified) opinion, this is the most viable option for virtually everyone.

By removing the Balanced Funds and their low returns (which come as a consequence of overdiversification and compounded fees I often talk about) from the equation and investing based on a system with a verified Edge instead…

You can bridge the Retirement Gap without working more, having a larger salary, or saving more than the standard amount.

To do this, you’d need a 9.66% annualized return with the other inputs intact (2.5% annual salary increase, 9.5% savings rate, 40-year working life).

There are many ways to bump up your investment returns in the long run. Which approach would work best for you mostly depends on the Investing Stage you’re in. (In this article, I explain the differences and best investing approaches for different situations in the three different Investing Stages.)

Look, the financial fraternity doesn’t want you to know these cheaper, better performing, and less time-consuming ways to invest exist.

Because if you knew this, they’d lose out on potentially hundreds of thousands of dollars in fees and commissions just from you.

But if you’re reading this article, you now know about these 4 inputs and that other investing options exist. And by becoming a self-directed investor, you can find the one that works best for you…

And maximize the chances of you enjoying a comfortable and self-sufficient retirement in the process.

When you take control of your investing, you’re free to create your own rule of returns to replace the flawed 9.5% & 7.5% rule. Meaning you become the master of your fate.

IMO, this is something you should strive for both in life and investing.

Take A Step Towards A Worry-Free Retirement NOW Instead Of Later

You don’t have to agree with me that option 4 from the previous section is your best bet for ensuring a financially self-sufficient retirement.

But if you want to have a comfortable retirement (for a couple all the inputs are obviously larger), you must do SOMETHING to snap out of the status quo by changing one, or more, of the other 3 inputs. Otherwise, you’ll find yourself in a pickle with your nest egg sooner or later.

Take a look at the four options I laid out for you again in the table below. Then rank them from 1 to 10 in terms of best fit to your circumstances.

In my case, I’ve learnt that allowing the compounding of investing returns to do the work for me has been far more efficient than trying to make huge adjustments to the other 3 inputs.

And if you choose option 4 too and need help on the path to creating a better rule of returns — you know where to find me.

You can verify all these numbers using this publicly available online calculator. Give us a call, or send us an email, if you’d like one of my team to walk you through using the calculator and chat about ways to solve the investing problem that everyone of us faces.

Phone: (+61) 03 9585 0300 | Aus: 1300 STOCKS

Email: info@sharewealthsystems.com.au

We’d be more than happy to help.

To your investing success.